In compliance with RBI's latest payment guidelines pertaining to online card data storage, CCAvenue has introduced 'TokenPay', a secure multi-network Card-on-File Tokenisation (CoFT) solution. CCAvenue TokenPay helps ecommerce businesses to continue providing their customers a 'saved card' experience with enhanced security across all major card networks, including MasterCard, RuPay, and Visa.

CCAvenue has always responded swiftly to the changes in the regulatory framework so as to continue providing uninterrupted services to millions of Indian online businesses and the end customers, without compromising on speed and efficiency.

Card-on-File Tokenisation is a payment card encryption process that substitutes the 16-digit static card number with a string of randomly generated numbers known as 'tokens' that are virtually impossible to decrypt. This technology secures the customer's payment information against the risk of any card data leaks and fraudulent activities, and ensures that access to such data remains exclusively with the customer, the card network, and the issuing bank, in compliance with the RBI norms.

-

RBI GuidelinesThe new RBI guidelines prevent online merchants, acquiring banks, and payment gateways/aggregators from storing customer-card related information, and permit only the Networks and Issuers to tokenize payment card information of the customer through his/her consent. Only these entities will be permitted to store the customer's card data and be responsible for issuing tokens for encryption of the card information.

-

CCAvenue TokenPayCCAvenue TokenPay is an interoperable tokenization solution for all online businesses, enabling seamless payments across card networks with maximum data security in full compliance with the RBI guidelines. Merchants using other payment gateways can also tokenize cards through CCAvenue and continue using their preferred gateways to process token-based transactions.

-

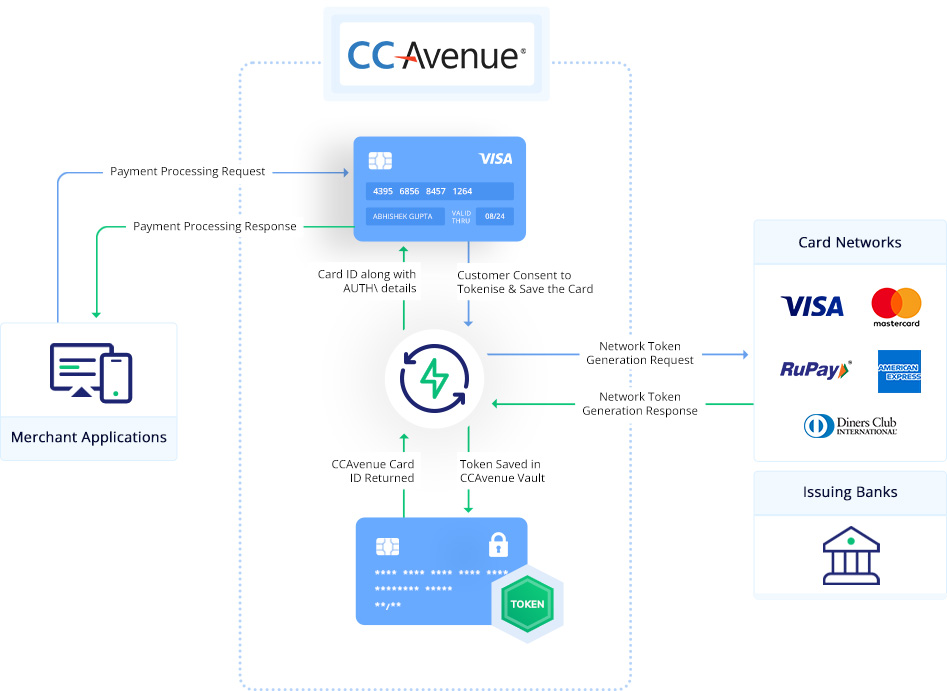

How it WorksNetwork tokenization relies on the card networks to provision merchant-specific tokens upon receiving the token request from the authorised entity (Token Requestor). The entire Token Provisioning Flow has been depicted below.

Once token provisioning is complete, then these securely stored tokens can be used for processing subsequent token-based transactions.

Once token provisioning is complete, then these securely stored tokens can be used for processing subsequent token-based transactions. -

Use CasesTokenisation would impact the following features and services that are offered by CCAvenue to its merchants.

- One Click Checkout

- Secure Vault

- Recurring Mandates

- Merchant Integration

- QR Code

- Mobile SDKs

CCAvenue TokenPayKey Features and Benefits-

Fully RBI CompliantOur robust solution helps the merchant offer a secured shopping experience to his customer while being RBI compliant through tokenisation of payment cards.

-

Strengthened SecurityCCAvenue TokenPay enhances payment security by replacing customer card numbers with Tokens so as to minimize the risk of card data leaks & fraudulent activities.

-

Single IntegrationOur unified platform enables token-based transactions across all networks without the requirement for additional certification with individual networks.

-

Multiple Gateway SupportOur interoperable TokenPay solution ensures that token-based transactions are processed across multiple payment gateways through a simple integration with us.

-

Increased Buyer ConfidenceCustomers can enjoy a seamless and secure shopping experience by entering and authenticating their payment card details once for subsequent use in future transactions.

-

Best Success RatesReduction in abandoned carts and failures driven by errors due to manual card data inputs, in addition to a delightful user experience are key factors leading to higher success rates.

The new RBI guidelines ensure highly secure and convenient online transactions for customers. In the absence of tokenisation, customers would need to enter their card information manually every time they make an online transaction which can lead to manual errors and transaction failures, thereby resulting in a poor user experience. With CCAvenue TokenPay, businesses can generate, process and manage tokens with customers' consent and continue offering a secure and frictionless online transaction experience every time!

INFIBEAM AVENUES

INFIBEAM AVENUES