smoother customer checkouts

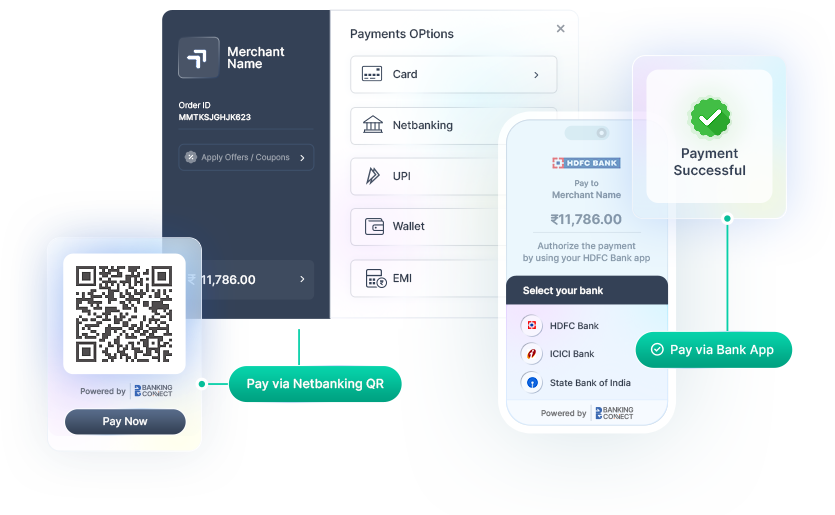

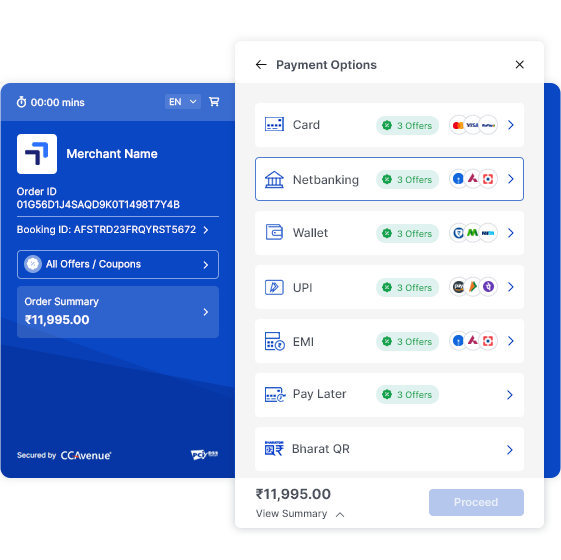

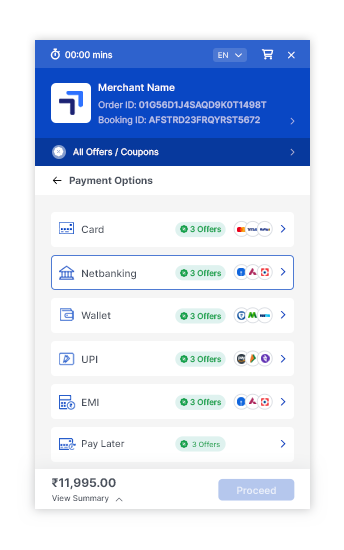

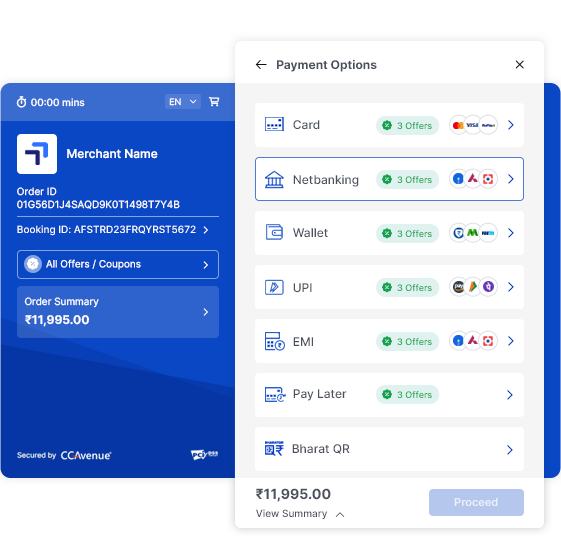

CCAvenue Banking Connect is a unified payment solution that enables merchants to accept bank payments through a single integration, powered by NPCI Bharat BillPay Limited (NBBL). It enhances traditional NetBanking with simpler, faster, and more reliable payment flows.

No. It enhances it. CCAvenue continues to support traditional NetBanking flow while introducing new QR and intent-based flows that simplify the process and improve transaction performance.

By reducing redirects and allowing customers to complete payments directly through their banking apps, CCAvenue Banking Connect minimizes drop-offs and ensures higher transaction completion ratios.

A single, standardized API connects merchants to all participating banks - simplifying onboarding, reducing technical overhead, and ensuring consistent transaction monitoring.

Yes. Built on NPCI's standardized NBBL banking framework and CCAvenue's robust infrastructure, CCAvenue Banking Connect ensures end-to-end encryption, secure authentication, and compliance with banking-grade standards.

AvenuesAI

AvenuesAI