Our Range of Contactless Payment Solutions to Fuel Your Business Growth

|

The pandemic is causing monumental changes in our daily habits and lifestyle. It has even started redefining the ways in which business is done and payments are being collected. The heightened concern about hygiene during the pandemic has seen consumers avoiding the use of cash for most transactions. In the present scenario, it has become challenging for businesses to accept payments while adhering to social distancing norms.

Contactless payment solutions are currently gaining considerable traction as they provide a safe and hygienic alternative to cash transactions. With nearly two decades of rich domain expertise in the field of digital payments and financial technology, CCAvenue offers you secured, reliable and speedy contactless payments. Our complete payment solution will ensure that your service translates into revenue with minimum technical inputs and maximum safety.

|

A Quick View at some of our key features offering digital payments

|

|

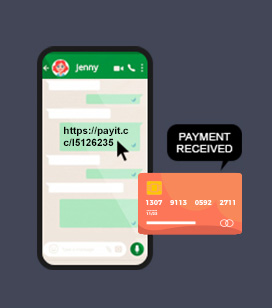

Invoice Payments

Accepting payments from your customers is now just a link away. Just create and send payment links to your customers via email SMS or Whatsapp and get paid immediately.

Aternativaly, you can choose to share detailed itemized invoices along with the payment terms, currency, description of the product/service, discount, late fees and taxes applicable along with a click-to-pay button on reviewing the invoice, the customer clicks the link and gets redirected to the payment page to complete the transaction. the entire process is fast, frictionless, and user-friendly

|

|

- Create an invoice link from your CCAvenue dashboard

- Share the invoice link with your customers over Whatsapp, SMS or email

- Enable your customers to make easy payments by clicking the link and choosing from 200+ online payment options.

- Receive the notification on settlement of the payment in your account.

|

|

|

QR PAY

Print the CCAvenue QR code generates specifically for you from the CCAvenue Dashboard and let your customers 'Scan and Pay' instantly through 200+ online payment option. You can avoid any physical exchange of cash.

QR code based transcations provide excellent sales opportunities for merchants as smartphone penetration is high in india and most of these devices feature built-in cameras that can read QR codes easily without the requirement for special apps.

|

|

|

|

Form Builder

We can create an independent customized application from which can be accessed by your customers from anywhere, anytime. You can use this from for accepting registrations , appointments or counsultation charges. Display it on your website or share it with your customers via email, SMS or Whatsapp. There's zero coding and no paperwork involved.

|

|

|

|

The transition to contactless payments is picking up momentum. CCAvenue equips our business partners with safe and convenient contactless payment solutions that enable you to accept payments quickly, securely and easily in these challenging times.

|

|

|

|

CCAvenue becomes the first Indian payment gateway to enter into an agreement with HSBC Bank for its Direct Debit facility

|

|

CCAvenue has inked an agreement with HSBC Bank for integration of its Direct Debit facility, which will soon be available to merchant partners on our comprehensive platform. This partnership will enable you to receive digital payments conveniently through the Net Banking mode from a large number of HSBC bank account holders. CCAvenue is the first third-party payment aggregator in the country to tie up with HSBC for its Direct Debit facility. We already have 59+ leading banks in our Direct Debit engine, which is currently the largest in South Asia.

|

|

|

|

|

|

|

INDUSTRY NEWS

|

|

Digital payments surge during lockdown to benefit telcos: Report

Source: economictimes.indiatimes.com

Digital payments in India are surging in the ongoing...

Read More

|

|

|

| |

|

Indians to lead in post-Covid adoption of e-payments: Study

Source: Times of India

Usage of digital payments in the post-Covid period is set to be the...

Read More

|

|

| |

Will consumer behaviour see shifts post covid-19?

Source: Livemint

Shifts in supply chain, increased usage of online shopping could be prevalent post covid-19...

Read More

|

|

|

| |

|

30 days into coronavirus lockdown: Impact on digital payment transactions

Source: Business Standard

As citizens came forward to help those affected by the lockdown...

Read More

|

|

| |

|

|

|

Disclaimer: We do not claim ownership over the images / articles appearing in the Industry News section. They are used for information purposes only and in no way are meant to claim ownership over any of the above mentioned. All photos, videos, articles, etc. are copyrighted to their original owners.

|

|

|

|