Avenues India: a quiet success story

4th October, 2004

Anupama Salvi believes that debit cards are and will continue to be the preferred medium over credit cards, especially in the asian region

Anupama Salvi believes that debit cards are and will continue to be the preferred medium over credit cards, especially in the asian region

This should be the stuff of fairy tales but it's not. A homegrown player, Avenues India, has changed the rules of the game with its economical payment gateway and e-commerce solutions to emerge as the largest player in the South Asian e-commerce space. Along the way, it has enabled the small merchant to reach out to the world, says SRIKANTH RP

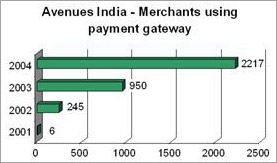

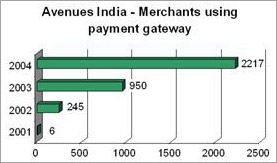

eBay's high-profile acquisition of baazee.com was recently in the news. Away from the headlines, a relatively unknown player, Avenues India, has emerged as the largest player in the South Asian e-commerce space. In the span of just three years, the company has gained a merchant base of over 2,200 customers with close to four websites going live using its payment gateway every single day. The number of transactions on its payment gateway is a mammoth 26,000 per month. The company says that more than 75 percent of Indian merchants who sell their goods online use its payment gateway for processing their transactions. This can be seen from its star-studded client list that includes the likes of the Tata group, the Indian Express group (publishers of this magazine), LG Electronics, GATI, IL&FS, Jammu & Kashmir Bank, the Somaiya group, the Mahindra group, the union ministry of commerce and industry, and the Transport Corporation of India.

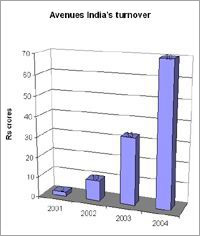

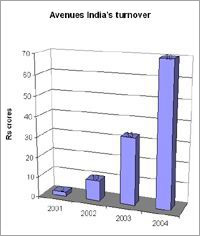

Avenues India's turnoverOne of the key reasons for the company's success is its economical payment gateway solution which lets merchants start e-commerce operations with a solution for as little as Rs 7,500. This is in stark contrast to the minimum of Rs 3 lakh that you would have to fork out for a rival payment gateway. Another strategic move is that of supporting debit cards instead of the industry norm of supporting only credit card transactions for Internet commerce. This move is significant as the credit card base in India is small when compared to that of debit cards. In 2001, the company was one of the few that realised the potential of enabling existing Internet bank accounts for online payments to boost e-commerce. Currently, the company has tie-ups with almost all Indian banks which offer Internet banking. Avenues' flagship product, CCAvenue, the payment gateway solution, has been well accepted by the industry as most companies do not want to invest a substantial amount in payment gateway solutions. These organisations want to test the online waters for their product offerings. Avenues enjoys an advantage over its rivals (say a Citibank or ICICI Bank) as it is the country's only neutral payment processing solution that allows transactions to be made using not only all credit card brands but also all Internet-enabled bank accounts at a fraction of the cost of current payment gateway solutions. Better yet, merchants having a tie-up with CCAvenue's solution can receive their payments in Indian rupees.

Avenues India's turnoverOne of the key reasons for the company's success is its economical payment gateway solution which lets merchants start e-commerce operations with a solution for as little as Rs 7,500. This is in stark contrast to the minimum of Rs 3 lakh that you would have to fork out for a rival payment gateway. Another strategic move is that of supporting debit cards instead of the industry norm of supporting only credit card transactions for Internet commerce. This move is significant as the credit card base in India is small when compared to that of debit cards. In 2001, the company was one of the few that realised the potential of enabling existing Internet bank accounts for online payments to boost e-commerce. Currently, the company has tie-ups with almost all Indian banks which offer Internet banking. Avenues' flagship product, CCAvenue, the payment gateway solution, has been well accepted by the industry as most companies do not want to invest a substantial amount in payment gateway solutions. These organisations want to test the online waters for their product offerings. Avenues enjoys an advantage over its rivals (say a Citibank or ICICI Bank) as it is the country's only neutral payment processing solution that allows transactions to be made using not only all credit card brands but also all Internet-enabled bank accounts at a fraction of the cost of current payment gateway solutions. Better yet, merchants having a tie-up with CCAvenue's solution can receive their payments in Indian rupees.

Beyond Indian shores

Beyond Indian shores

While the Indian market is showing signs of huge growth, the global market is much bigger. With a view to offer a bigger base to its merchants, Avenues has tied up with 20 of the biggest Chinese and Hong Kong-based banks for direct debit facilities. This agreement gives merchants using the CCAvenue payment gateway solution access to more than 376 million Chinese Net banking users. To further strengthen its presence in the Far East, the company has entered into agreements with the top three banks in Singapore-Citibank, DBS and UOB-for direct debit. This tie-up has been received very well in Singapore, with 350 merchants signing up in just three months.

Says Anupama Salvi, the company's chief operating officer, "Everyone does not own a credit card. We believe that debit cards are and will continue to be the preferred medium over credit cards, especially in the Asian region, which is credit card averse. Going forward, our aim is to build the world's biggest direct debit payment engine." This is in addition to the support for all credit card brands, thus giving the customer the option of paying through any medium he wants.

The biggest market is undoubtedly the country that most players are bullish about-the US. For tapping this market, the company has entered into a tie-up with a US-based organisation which will allow American customers of any bank to issue virtual cheques to merchants using Avenues' payment gateway. Effectively, this means that a merchant using Avenues' payment gateway solution can offer payment options to customers in the biggest economy, the US, and in emerging economies, India, China and other South Asian countries. If everything goes as planned, Avenues will have created a large parallel payment processing mechanism.

Observes Aparna Gawande, chief technology officer, Avenues, "Managing the scale of transactions regardless of geographical, legal, cultural, language and currency barriers will be a major challenge. Our aim will be to build an alternate form of electronic payment which is cost-effective and 100 percent fraud proof."

eBay's high-profile acquisition of baazee.com was recently in the news. Away from the headlines, a relatively unknown player, Avenues India, has emerged as the largest player in the South Asian e-commerce space. In the span of just three years, the company has gained a merchant base of over 2,200 customers with close to four websites going live using its payment gateway every single day. The number of transactions on its payment gateway is a mammoth 26,000 per month. The company says that more than 75 percent of Indian merchants who sell their goods online use its payment gateway for processing their transactions. This can be seen from its star-studded client list that includes the likes of the Tata group, the Indian Express group (publishers of this magazine), LG Electronics, GATI, IL&FS, Jammu & Kashmir Bank, the Somaiya group, the Mahindra group, the union ministry of commerce and industry, and the Transport Corporation of India.

Avenues India's turnoverOne of the key reasons for the company's success is its economical payment gateway solution which lets merchants start e-commerce operations with a solution for as little as Rs 7,500. This is in stark contrast to the minimum of Rs 3 lakh that you would have to fork out for a rival payment gateway. Another strategic move is that of supporting debit cards instead of the industry norm of supporting only credit card transactions for Internet commerce. This move is significant as the credit card base in India is small when compared to that of debit cards. In 2001, the company was one of the few that realised the potential of enabling existing Internet bank accounts for online payments to boost e-commerce. Currently, the company has tie-ups with almost all Indian banks which offer Internet banking. Avenues' flagship product, CCAvenue, the payment gateway solution, has been well accepted by the industry as most companies do not want to invest a substantial amount in payment gateway solutions. These organisations want to test the online waters for their product offerings. Avenues enjoys an advantage over its rivals (say a Citibank or ICICI Bank) as it is the country's only neutral payment processing solution that allows transactions to be made using not only all credit card brands but also all Internet-enabled bank accounts at a fraction of the cost of current payment gateway solutions. Better yet, merchants having a tie-up with CCAvenue's solution can receive their payments in Indian rupees.

Avenues India's turnoverOne of the key reasons for the company's success is its economical payment gateway solution which lets merchants start e-commerce operations with a solution for as little as Rs 7,500. This is in stark contrast to the minimum of Rs 3 lakh that you would have to fork out for a rival payment gateway. Another strategic move is that of supporting debit cards instead of the industry norm of supporting only credit card transactions for Internet commerce. This move is significant as the credit card base in India is small when compared to that of debit cards. In 2001, the company was one of the few that realised the potential of enabling existing Internet bank accounts for online payments to boost e-commerce. Currently, the company has tie-ups with almost all Indian banks which offer Internet banking. Avenues' flagship product, CCAvenue, the payment gateway solution, has been well accepted by the industry as most companies do not want to invest a substantial amount in payment gateway solutions. These organisations want to test the online waters for their product offerings. Avenues enjoys an advantage over its rivals (say a Citibank or ICICI Bank) as it is the country's only neutral payment processing solution that allows transactions to be made using not only all credit card brands but also all Internet-enabled bank accounts at a fraction of the cost of current payment gateway solutions. Better yet, merchants having a tie-up with CCAvenue's solution can receive their payments in Indian rupees.  Beyond Indian shores

Beyond Indian shoresWhile the Indian market is showing signs of huge growth, the global market is much bigger. With a view to offer a bigger base to its merchants, Avenues has tied up with 20 of the biggest Chinese and Hong Kong-based banks for direct debit facilities. This agreement gives merchants using the CCAvenue payment gateway solution access to more than 376 million Chinese Net banking users. To further strengthen its presence in the Far East, the company has entered into agreements with the top three banks in Singapore-Citibank, DBS and UOB-for direct debit. This tie-up has been received very well in Singapore, with 350 merchants signing up in just three months.

Says Anupama Salvi, the company's chief operating officer, "Everyone does not own a credit card. We believe that debit cards are and will continue to be the preferred medium over credit cards, especially in the Asian region, which is credit card averse. Going forward, our aim is to build the world's biggest direct debit payment engine." This is in addition to the support for all credit card brands, thus giving the customer the option of paying through any medium he wants.

The biggest market is undoubtedly the country that most players are bullish about-the US. For tapping this market, the company has entered into a tie-up with a US-based organisation which will allow American customers of any bank to issue virtual cheques to merchants using Avenues' payment gateway. Effectively, this means that a merchant using Avenues' payment gateway solution can offer payment options to customers in the biggest economy, the US, and in emerging economies, India, China and other South Asian countries. If everything goes as planned, Avenues will have created a large parallel payment processing mechanism.

Observes Aparna Gawande, chief technology officer, Avenues, "Managing the scale of transactions regardless of geographical, legal, cultural, language and currency barriers will be a major challenge. Our aim will be to build an alternate form of electronic payment which is cost-effective and 100 percent fraud proof."

Aparna Gawande wants to build an alternate form of electronic payment which is cost-effective and 100 percent fraud-proof

Aparna Gawande wants to build an alternate form of electronic payment which is cost-effective and 100 percent fraud-proof

Using the foundation

While the foundation (payment gateway) is in place, Avenues knows that exponential growth will not come its way unless it offers products for industry verticals. Accordingly, the company began its search for domains that leverage the power of the Internet to boost e-commerce transactions. The first solution, ResAvenue, a hotel reservation engine with an in-built payment gateway solution, has already been snapped up by 100 hotels. Here too the company is targeting the high-growth tourism sector which can use the Internet to attract global customers. While many Indian hotels do have Websites, online interaction is restricted to initial contact through the site. In the absence of a proper e-commerce solution, the rest of the transaction is still done through the traditional model: telephone, e-mail or fax. While there is a clear need, not many hotels (apart from, say, the Taj group) have the ability to complete a transaction online. Here too, the sensible pricing; a hotel can start with a solution that costs as less as Rs 10,000, along with powerful features such as an in-built CRM module-has made Avenues' product successful.

The company's next offering, CineAvenue, is scheduled to be launched next month. With an online ticketing and payment engine, CineAvenue is aimed at cinema houses, multiplexes and entertainment venues. Customers can see the seats they are buying on the Net, with support for mobile-based payments. Next in the line is EventAvenue, which will provide an event organiser with all the tools he needs to manage an event. From putting up the layout of the space for sale, to selling space to exhibitors, to managing the invitee list and issuing tickets, the product covers all the aspects of hosting an event. All the products have support for transactions in several currencies (US $, the Euro, Singapore $ and the Indian Rupee).

Avenues India has a two-part strategy. The first, using the payment gateway, has already been executed. The second is the challenge of enabling more customers to buy on the Net by developing specialised products to boost e-commerce. From the way the company has been growing, this strategy is paying off. From a mere six customers in 2001, Avenues has more than 2,200 today, and its turnover has zoomed from Rs 2 crore to Rs 70 crore.

The success of Avenues can be explained simply - create an opportunity by offering a technologically good product at an affordable price to Indian organisations. While Avenues indeed has big names on its client list, the success of the company in encouraging even small merchants to look at the power of the Internet is the real e-commerce revolution taking place in the country.

Partial customer list

While the foundation (payment gateway) is in place, Avenues knows that exponential growth will not come its way unless it offers products for industry verticals. Accordingly, the company began its search for domains that leverage the power of the Internet to boost e-commerce transactions. The first solution, ResAvenue, a hotel reservation engine with an in-built payment gateway solution, has already been snapped up by 100 hotels. Here too the company is targeting the high-growth tourism sector which can use the Internet to attract global customers. While many Indian hotels do have Websites, online interaction is restricted to initial contact through the site. In the absence of a proper e-commerce solution, the rest of the transaction is still done through the traditional model: telephone, e-mail or fax. While there is a clear need, not many hotels (apart from, say, the Taj group) have the ability to complete a transaction online. Here too, the sensible pricing; a hotel can start with a solution that costs as less as Rs 10,000, along with powerful features such as an in-built CRM module-has made Avenues' product successful.

The company's next offering, CineAvenue, is scheduled to be launched next month. With an online ticketing and payment engine, CineAvenue is aimed at cinema houses, multiplexes and entertainment venues. Customers can see the seats they are buying on the Net, with support for mobile-based payments. Next in the line is EventAvenue, which will provide an event organiser with all the tools he needs to manage an event. From putting up the layout of the space for sale, to selling space to exhibitors, to managing the invitee list and issuing tickets, the product covers all the aspects of hosting an event. All the products have support for transactions in several currencies (US $, the Euro, Singapore $ and the Indian Rupee).

Avenues India has a two-part strategy. The first, using the payment gateway, has already been executed. The second is the challenge of enabling more customers to buy on the Net by developing specialised products to boost e-commerce. From the way the company has been growing, this strategy is paying off. From a mere six customers in 2001, Avenues has more than 2,200 today, and its turnover has zoomed from Rs 2 crore to Rs 70 crore.

The success of Avenues can be explained simply - create an opportunity by offering a technologically good product at an affordable price to Indian organisations. While Avenues indeed has big names on its client list, the success of the company in encouraging even small merchants to look at the power of the Internet is the real e-commerce revolution taking place in the country.

Partial customer list

- Jammu & Kashmir Bank

- LG Electronics

- Modicare

- IL&FS

- Press Trust of India

- GATI

- Mahindra & Mahindra

- Somaiya group

- Imax Adlabs Multiplex

- Transport Corporation of India

- Indian Express group

- Tata group

- oxfordbookstore.com

- indiainfo.com

- C-DAC

INFIBEAM AVENUES

INFIBEAM AVENUES