CCAvenue demystifies GST and its impact on eCommerce businesses

3rd July, 2017

What is GST?

GST (Goods and Services Tax) is the single biggest tax reform in India that has replaced the multiple cascading taxes like sales tax, service tax, VAT, entertainment tax, luxury tax, excise duty, customs duty, octroi, entry tax, etc. levied by the central and state governments. GST is a uniform indirect tax for goods and services right from manufacturers to the end consumers for the entire country bringing them under one umbrella to make compliance easier. This unified tax platform to collect and pay taxes is set to dramatically reshape the country's $2-trillion economy.

Primarily, there are three types of taxes under GST:

Who is liable to pay GST?

Under the GST regime, the tax is payable on the supply of goods and/or services. Liability to pay tax arises when the taxable business entity crosses the turnover threshold of Rs. 20 lakhs (Rs. 10 lakhs for NE and special category states). Business entities wanting to collect GST or claim input (despite being below threshold limit) can take voluntary registration. In certain limited cases, the taxable business entity must pay GST regardless of whether he has traversed the threshold limit or not.

The following categories of businesses shall be required to register, irrespective of the threshold limit:

How to be GST compliant?

1) Registration process for a new seller

A seller has to fill in registration application in less than 30 days of crossing the prescribed threshold or starting of a business. Here, the date of application would be considered the effective date of registration for obtaining Input Tax Credit (ITC).

Where the seller has submitted an application for registration after 30 days from the date of becoming liable to register for GST, the effective date of registration shall be the date on which the registration is granted.

2) Registration process for an existing seller

All sellers registered with central or state tax authorities would be migrated to GST by default and allotted Goods and Service Tax Identification Number (GSTIN). Sellers falling below the threshold may continue to be registered and get benefits of GST credit chain or opt out themselves.

In the event of a person holding the registration voluntarily while being inside the threshold exemption limit for paying tax, the effective date of registration shall be the date of the order of enrollment.

3) GSTIN:

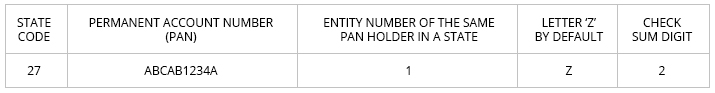

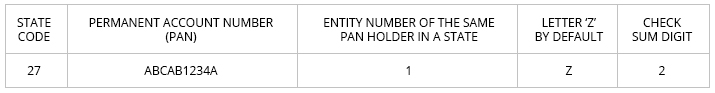

Goods and Services Tax Identification Number (GSTIN) is a 15-digit long alphanumeric value comprising the State Code, PAN Card, and business vertical details.

What will be the impact of GST on ecommerce businesses?

GST is expected to have a far reaching impact. Whether you run a business or provide a service, however big or small, it is very likely GST will impact you. Let's first understand what E-Commerce & E-Commerce Operator means under the ambit of GST:

"E-Commerce" is defined as the supply and receipt of goods or services or both, or transmitting of funds or data, over an electronic network.

An "E-Commerce Operator" is defined as every person who, directly or indirectly, owns, operates or manages an electronic platform engaged in facilitating the supply of goods and/or services. Also, a person providing information or any other services incidental to or in connection with such supply of goods and services through electronic platform would be considered as an Operator. A person supplying goods/services on his own account, however, would not be considered as an Operator.

Let's look at few scenarios to understand how GST will be applicable to various ecommerce businesses:

GST (Goods and Services Tax) is the single biggest tax reform in India that has replaced the multiple cascading taxes like sales tax, service tax, VAT, entertainment tax, luxury tax, excise duty, customs duty, octroi, entry tax, etc. levied by the central and state governments. GST is a uniform indirect tax for goods and services right from manufacturers to the end consumers for the entire country bringing them under one umbrella to make compliance easier. This unified tax platform to collect and pay taxes is set to dramatically reshape the country's $2-trillion economy.

Primarily, there are three types of taxes under GST:

- 1) CGST(Central Goods and Services Tax): Tax levied by the Centre on intra-State supply of goods or services

- 2) SGST(State Goods and Services Tax): Tax levied by the States on intra-State supply of goods or services

- 3) IGST (Integrated Goods and Services Tax): Tax levied by the Centre on inter-state supply of goods and services

Who is liable to pay GST?

Under the GST regime, the tax is payable on the supply of goods and/or services. Liability to pay tax arises when the taxable business entity crosses the turnover threshold of Rs. 20 lakhs (Rs. 10 lakhs for NE and special category states). Business entities wanting to collect GST or claim input (despite being below threshold limit) can take voluntary registration. In certain limited cases, the taxable business entity must pay GST regardless of whether he has traversed the threshold limit or not.

The following categories of businesses shall be required to register, irrespective of the threshold limit:

- 1) All ecommerce businesses.

- 2) Existing business entities registered with the central (Excise / Service Tax) or state (VAT) authorities.

- 3) Those making inter-state taxable supply of goods/services.

- 4) Business entities liable to pay tax under reverse charge in GST ambit.

- 5) Agents or any other person who makes supply on behalf of other registered taxable persons.

How to be GST compliant?

1) Registration process for a new seller

A seller has to fill in registration application in less than 30 days of crossing the prescribed threshold or starting of a business. Here, the date of application would be considered the effective date of registration for obtaining Input Tax Credit (ITC).

Where the seller has submitted an application for registration after 30 days from the date of becoming liable to register for GST, the effective date of registration shall be the date on which the registration is granted.

2) Registration process for an existing seller

All sellers registered with central or state tax authorities would be migrated to GST by default and allotted Goods and Service Tax Identification Number (GSTIN). Sellers falling below the threshold may continue to be registered and get benefits of GST credit chain or opt out themselves.

In the event of a person holding the registration voluntarily while being inside the threshold exemption limit for paying tax, the effective date of registration shall be the date of the order of enrollment.

3) GSTIN:

Goods and Services Tax Identification Number (GSTIN) is a 15-digit long alphanumeric value comprising the State Code, PAN Card, and business vertical details.

What will be the impact of GST on ecommerce businesses?

GST is expected to have a far reaching impact. Whether you run a business or provide a service, however big or small, it is very likely GST will impact you. Let's first understand what E-Commerce & E-Commerce Operator means under the ambit of GST:

"E-Commerce" is defined as the supply and receipt of goods or services or both, or transmitting of funds or data, over an electronic network.

An "E-Commerce Operator" is defined as every person who, directly or indirectly, owns, operates or manages an electronic platform engaged in facilitating the supply of goods and/or services. Also, a person providing information or any other services incidental to or in connection with such supply of goods and services through electronic platform would be considered as an Operator. A person supplying goods/services on his own account, however, would not be considered as an Operator.

Let's look at few scenarios to understand how GST will be applicable to various ecommerce businesses:

-

1) Sellers Supply to Customers Directly:

Sellers supply goods/services to the customers directly through their own website and do not rely on an E-Commerce Operator for listing of their goods or services. In this case, the seller shall charge CGST and SGST for intra-state transactions and IGST for inter-state transactions. -

2) Sellers Supply to Customers via E-Commerce Operators:

Products of the seller are listed on the E-Commerce Operators' website. The order placed by customer is booked by the operator on behalf of the seller and then routed to him for delivery. In this case, the seller shall charge GST on the goods and the E-Commerce Operator shall generate an invoice in the name of the seller and charge GST according to the services given to him. -

3) E-Commerce Operators Buy from Sellers and Supply to Customers:

E-Commerce Operator buys goods from the Seller and delivers it to the Customer. This means that the role of the E-Commerce Operator is not limited to provide a platform for facilitating sales but also to become the owner of the goods. In this case, the Seller charges GST on the goods and raises an invoice to the Operator and, in turn the Operator issues an invoice to the Customer.

- 1) Removal of bundled indirect taxes such as VAT, CST, Service tax, CAD, SAD, and Excise

- 2) Pan-Indian rate structure

- 3) Higher threshold for registration

- 4) Simplification of tax procedures

- 5) Improved tax compliance

- 6) Removal of cascading effect of taxes i.e. removes tax on tax

- 7) Higher transparency in state wise tax regimes

- 8) Smoother interstate logistics management with a common tax

- 9) Increase in GDP

- 10) A coherent flow of Input Tax Credit

- 11) Reduction in tax evasion

INFIBEAM AVENUES

INFIBEAM AVENUES