Merchant Registration & On-boarding Process

Introduction

CCAvenue's Merchant Registration and On-Boarding Process ensures proper assessment, evaluation and

finalization of Merchants for availing CCAvenue's payment gateway services.

There are four separate teams involved in the On-Boarding Process:

- Merchant Underwriting Team

- Merchant Operations Team

- Legal Team

- Risk Management Team

The on-boarding process tasks are distinctly divided across these teams, which need to collaborate with each other as well as exchange evaluations and assessment data. This minimizes bias and acts as a maker-checker buffer to eliminate 'undesirable' merchants. These undesirable merchants include those belonging in the prohibited list, those conducting businesses that are in the 'grey area' of legality, businesses of risky nature that may lead to cheating or short changing of customers and thereby raising potential customer disputes; and merchants who have had a past track record of malpractice or legally questionable business history.

The processes mentioned herein are formulated taking into consideration guidelines of the regulator, industry best practices, recommendations of banking partners and most of all, our 20 years of experience of on-boarding and managing thousands of merchants on our system.

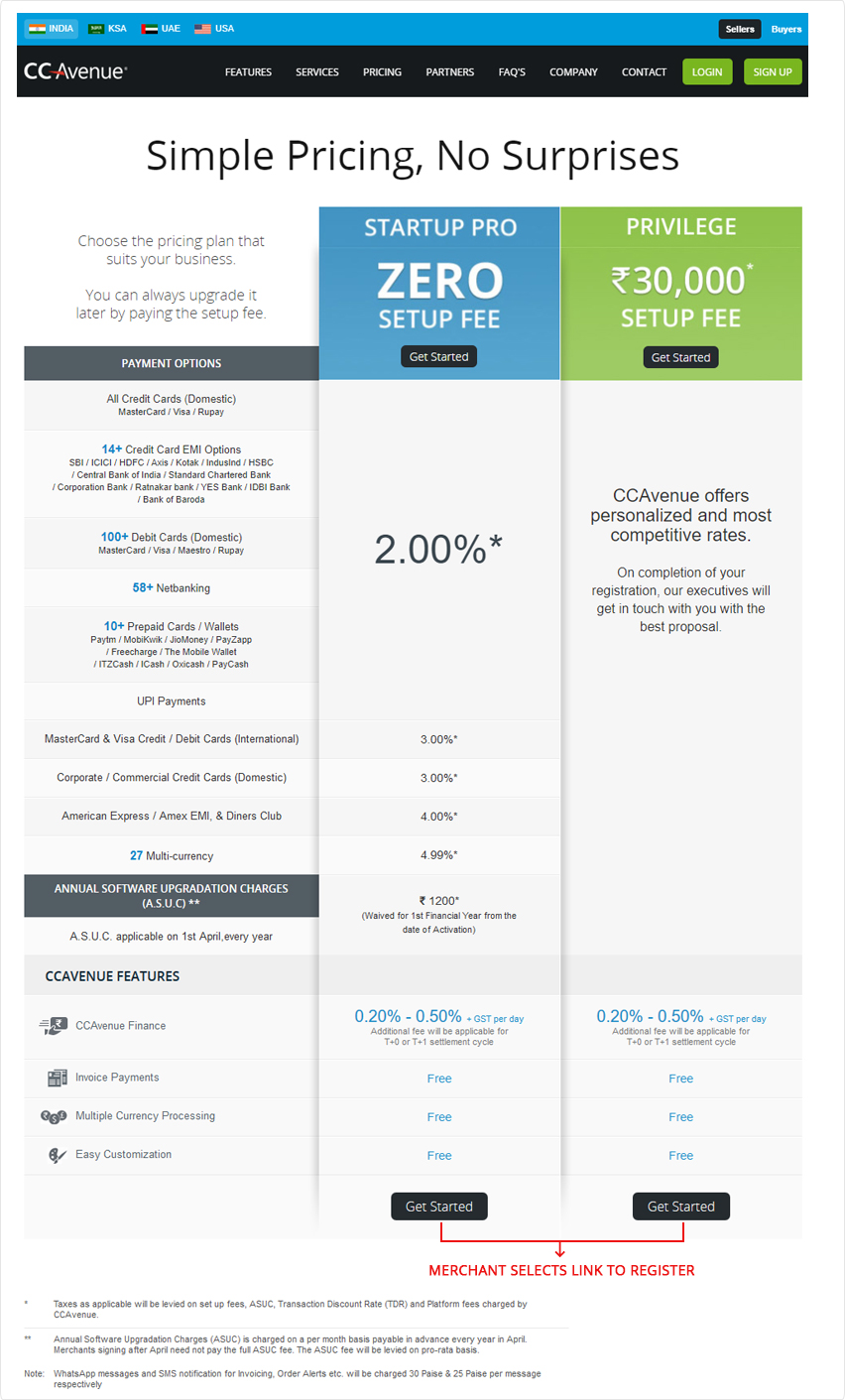

Merchant Registration

Signing up as a merchant with CCAvenue is a simple process. Interested merchants are requested to fill

up an online signup form accessible on the CCAvenue website.

The merchant is informed of the list of businesses for which CCAvenue will not offer payment processing. You can checkout 'What are the businesses that are not accepted by CCAvenue?' under the header 'About CCAvenue as a payment gateway' in the FAQs for this information.

Prohibited Businesses

Adult products:

Adult goods and services which include pornography and other sexually suggestive materials (including literature, imagery and other media); escort or prostitution services and massage parlors: Payment of potentially sexual related services.

Copyrights:

Fake certificates:

Government IDs or documents which include fake IDs, passports, diplomas, and noble titles.

Drugs:

Replica products:

Counterfeit and unauthorized goods; including replicas or imitations of designer goods; items without a celebrity endorsement that would normally require such an association; fake autographs, counterfeit stamps, and other potentially unauthorized goods.

Gambling:

Gaming/gambling which includes lottery tickets, sports bets, memberships/ enrolment in online gambling sites, and related content, Casino gaming chips, off-Track betting and wagers at race tracks.

Sharp objects:

Weapons, which include firearms, ammunition, knives, brass knuckles, gun parts, and other armaments

Tobacco and cigarettes:

Tobacco and cigarettes, which include cigarettes, cigars, chewing tobacco, and related products and unlawful sale of Tobacco: Online sale of tobacco products by a retailer that is not:

Live plants / animals:

Currencies:

Human parts:

Body parts which include organs or other body parts

Online trading:

Securities that include online trading of stocks and bonds etc

Devices:

Offensive goods: (Promoting intolerance or hatred)

Offensive goods include crime scene photos or items, such as personal belongings, associated with criminals.

Alcohol:

Alcohol or alcoholic beverages such as beer, liquor, wine, or champagne

Child pornography:

Any element which includes pornographic materials involving minors

Hacking and cracking tools:

Materials which include manuals, how-to guides, information, or equipment enabling illegal access to software, servers, websites, or other protected property.

Illegal goods:

Includes materials, products, or information promoting illegal goods or enabling illegal acts

Miracle cures:

Includes unsubstantiated cures, remedies or other items marketed as quick health fixes

Medical marijuana dispensary:

Seller of marijuana used for medicinal purposes

Regulated goods:

Which include air bags; batteries containing mercury; Freon or similar substances/refrigerants; chemical/industrial solvents; government uniforms; car titles; license plates; police badges and law enforcement equipment; lock-picking devices; pesticides; postage meters; recalled items; slot machines; surveillance equipment; goods regulated by government or other agency specifications

Multi-level pyramid selling:

Multi-level marketing system which uses one or more of the following practices which may be considered deceptive:

Matrix sites:

Matrix sites or sites using a matrix scheme approach

Work-from-home:

Work-from-home/earn online schemes

Drop-shipped merchandise

Bureau de change establishments:

Facility for card members to purchase Foreign Exchange currency

Cheque cashing / guarantee:

Card member (Merchant) can transact cheque for cash using American Express as a check guarantee card.

Condo (real estate) down payments:

Payments to other debt related real estate products

Debt collection:

Collection Agencies, Factoring Companies, Liquidators, Bailiffs, Credit Restoration Services and Bankruptcy Lawyers

Door to door sales:

Unsolicited vendors with immediate payment expectation.

Investment on futures maturity / value of goods:

Investment made on futures maturity of Goods/Services with an intention of gaining return on investment. (E.g. stock market, wine future, horse breeding, or timber investment).

Leasing merchants:

Payments to other debt related real estate products - Leasing Merchants (US)

Mortgage payments:

Payments to other debt related real estate products - Mortgage Payments (US).

Political parties:

Donations

Telecommunications services:

Including wireless, cable, satellite, wire line, ISP, calling cards, long distance Phone / Card Reader, Airplane Telephones, Cellular Products/Services.

Mobile point of sale:

Electronic point of sale terminal.

Unregulated charities:

Merchant that does not have a Tax exemption or local council registration number.

Card member activated terminals:

Road tolls, car parking lots and garages, petrol pumps, cinema kiosks as well as railway self-service ticketing

Internet auctions:

Any form of auctioning conducted on the Internet (excluding North America region).

Internet electronic delivery:

Merchants (including E-tickets that are redeemable in person) and Internet Electronic Services

Night club:

Related e.g. Night Club Hostess, Night Club Lounges, Disco, or Gentlemen's Club

Premium rate telephone services:

All 1-900 lines

Timeshares:

The selling of part ownership of a property for use as a holiday home, whereby a card member can buy the right to use the property for the same fixed period annually.

PC support services:

Providing diagnostic, troubleshooting, maintenance and repair services for a computer or similar device

Franchisee services:

A party (franchisee) acquired to allow them to have access to a business's (the franchiser) proprietary knowledge, processes, and trademarks in order to allow the party to sell a product or provide a service under the business's name.

Any product or service, which is not in compliance with all applicable laws and regulations whether federal, state, local or international including the laws of India.

Mixed businesses:

If any merchant is found to be availing CCAvenue's service for the above mentioned business types without Infibeam Avenues' written approval then the merchant will be subject to appropriate proceedings and, services of Infibeam Avenues to this merchant will be terminated on an immediate basis.

*CCAvenue reserves all rights to approve or disapprove any merchant at its sole discretion.

Adult goods and services which include pornography and other sexually suggestive materials (including literature, imagery and other media); escort or prostitution services and massage parlors: Payment of potentially sexual related services.

Copyrights:

- Copyright unlocking devices which include Mod chips or other devices designed to circumvent copyright protection.

- Copyrighted media which includes unauthorized copies of books, music, movies, and other licensed or protected materials.

- Copyrighted software which includes unauthorized copies of software, video games and other licensed or protected materials, including OEM or bundled software

Fake certificates:

Government IDs or documents which include fake IDs, passports, diplomas, and noble titles.

Drugs:

- Drugs and drug paraphernalia which include illegal drugs and drug accessories, including herbal drugs like salvia and magic mushrooms.

-

Unlawful sale of Prescription Drugs: Online sale of prescription drugs to consumers

by a pharmacy that is not, either;

- Certified by VIPPS® (Verified Internet Pharmacy Practice Sites) or

- Licensed by the board of pharmacy in the state in which it is located.

- Drug test circumvention aids which include drug cleansing shakes, urine test additives, and related items.

- Prescription drugs or herbal drugs or any kind of online pharmacies which include drugs or other products requiring a prescription by a licensed medical practitioner.

Replica products:

Counterfeit and unauthorized goods; including replicas or imitations of designer goods; items without a celebrity endorsement that would normally require such an association; fake autographs, counterfeit stamps, and other potentially unauthorized goods.

Gambling:

Gaming/gambling which includes lottery tickets, sports bets, memberships/ enrolment in online gambling sites, and related content, Casino gaming chips, off-Track betting and wagers at race tracks.

Sharp objects:

Weapons, which include firearms, ammunition, knives, brass knuckles, gun parts, and other armaments

Tobacco and cigarettes:

Tobacco and cigarettes, which include cigarettes, cigars, chewing tobacco, and related products and unlawful sale of Tobacco: Online sale of tobacco products by a retailer that is not:

- Certified to pay state taxes, and/or;

- Preventing sale of tobacco products to under-age consumers.

Live plants / animals:

- Endangered species which include plants, animals or other organisms (including product derivatives) in danger of extinction.

- Live animals or hides/skins/teeth, nails and other parts etc. of animals.

Currencies:

- Wholesale currency which includes discounted currencies or currency exchanges

- Merchant dealing in Crypto Currencies

Human parts:

Body parts which include organs or other body parts

Online trading:

Securities that include online trading of stocks and bonds etc

Devices:

- Cable descramblers and black boxes which include devices intended to obtain cable and satellite signals for free.

- Pyrotechnic devices and hazardous materials which include fireworks and related goods; toxic, flammable, and radioactive materials and substances.

- Traffic devices, which include radar detectors/jammers, license plate covers, traffic signal changers, and related products.

Offensive goods: (Promoting intolerance or hatred)

- Defame or slander any person or groups of people based on race, ethnicity, national origin, religion, sex, or other factors.

- Encourage or incite violent acts.

- Promote intolerance or hatred.

Offensive goods include crime scene photos or items, such as personal belongings, associated with criminals.

Alcohol:

Alcohol or alcoholic beverages such as beer, liquor, wine, or champagne

Child pornography:

Any element which includes pornographic materials involving minors

Hacking and cracking tools:

Materials which include manuals, how-to guides, information, or equipment enabling illegal access to software, servers, websites, or other protected property.

Illegal goods:

Includes materials, products, or information promoting illegal goods or enabling illegal acts

Miracle cures:

Includes unsubstantiated cures, remedies or other items marketed as quick health fixes

Medical marijuana dispensary:

Seller of marijuana used for medicinal purposes

Regulated goods:

Which include air bags; batteries containing mercury; Freon or similar substances/refrigerants; chemical/industrial solvents; government uniforms; car titles; license plates; police badges and law enforcement equipment; lock-picking devices; pesticides; postage meters; recalled items; slot machines; surveillance equipment; goods regulated by government or other agency specifications

Multi-level pyramid selling:

Multi-level marketing system which uses one or more of the following practices which may be considered deceptive:

- Participants pay money for the right to receive compensation for recruiting new participants;

- A participant is required to buy a specific quantity of products, other than at cost price for the purpose of advertising, before the participant is allowed to join the plan or advance within the plan;

- Participants are knowingly sold commercially unreasonable quantities of the product or products (this practice is called inventory loading)

- Participants are not allowed to return products on reasonable commercial

- Other Payment Service Providers (except to the extent the entity itself sells goods to which it has title): payments services providers (PSP), other merchant aggregators.

Matrix sites:

Matrix sites or sites using a matrix scheme approach

Work-from-home:

Work-from-home/earn online schemes

Drop-shipped merchandise

Bureau de change establishments:

Facility for card members to purchase Foreign Exchange currency

Cheque cashing / guarantee:

Card member (Merchant) can transact cheque for cash using American Express as a check guarantee card.

Condo (real estate) down payments:

Payments to other debt related real estate products

Debt collection:

Collection Agencies, Factoring Companies, Liquidators, Bailiffs, Credit Restoration Services and Bankruptcy Lawyers

Door to door sales:

Unsolicited vendors with immediate payment expectation.

Investment on futures maturity / value of goods:

Investment made on futures maturity of Goods/Services with an intention of gaining return on investment. (E.g. stock market, wine future, horse breeding, or timber investment).

Leasing merchants:

Payments to other debt related real estate products - Leasing Merchants (US)

Mortgage payments:

Payments to other debt related real estate products - Mortgage Payments (US).

Political parties:

Donations

Telecommunications services:

Including wireless, cable, satellite, wire line, ISP, calling cards, long distance Phone / Card Reader, Airplane Telephones, Cellular Products/Services.

Mobile point of sale:

Electronic point of sale terminal.

Unregulated charities:

Merchant that does not have a Tax exemption or local council registration number.

Card member activated terminals:

Road tolls, car parking lots and garages, petrol pumps, cinema kiosks as well as railway self-service ticketing

Internet auctions:

Any form of auctioning conducted on the Internet (excluding North America region).

Internet electronic delivery:

Merchants (including E-tickets that are redeemable in person) and Internet Electronic Services

Night club:

Related e.g. Night Club Hostess, Night Club Lounges, Disco, or Gentlemen's Club

Premium rate telephone services:

All 1-900 lines

Timeshares:

The selling of part ownership of a property for use as a holiday home, whereby a card member can buy the right to use the property for the same fixed period annually.

PC support services:

Providing diagnostic, troubleshooting, maintenance and repair services for a computer or similar device

Franchisee services:

A party (franchisee) acquired to allow them to have access to a business's (the franchiser) proprietary knowledge, processes, and trademarks in order to allow the party to sell a product or provide a service under the business's name.

Any product or service, which is not in compliance with all applicable laws and regulations whether federal, state, local or international including the laws of India.

Mixed businesses:

If any merchant is found to be availing CCAvenue's service for the above mentioned business types without Infibeam Avenues' written approval then the merchant will be subject to appropriate proceedings and, services of Infibeam Avenues to this merchant will be terminated on an immediate basis.

*CCAvenue reserves all rights to approve or disapprove any merchant at its sole discretion.

Close

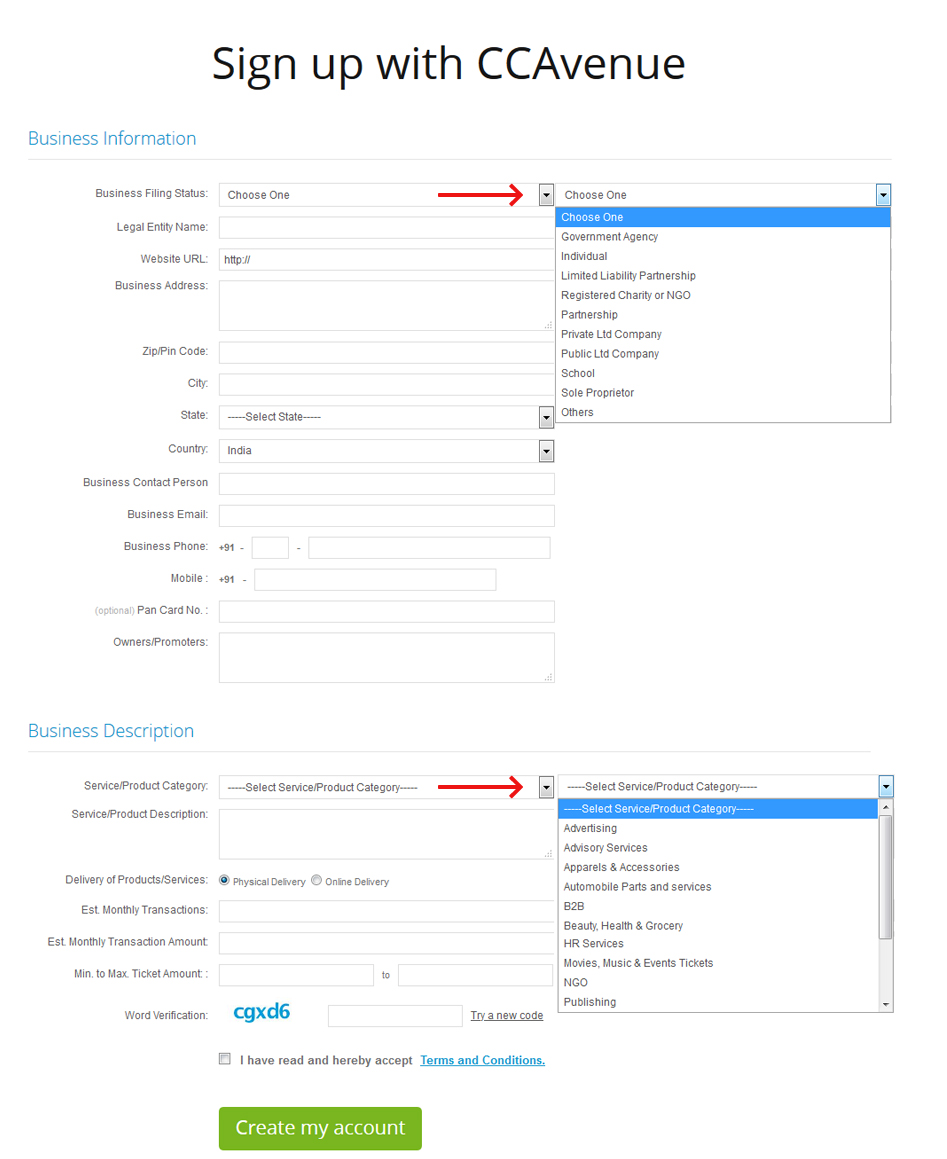

Online Signup Form

The Merchant Registration Form is available on the website for easy access. It

serves a dual purpose:

The information points requested from the prospective merchant helps us screen the merchant at this level itself. The idea is to solicit applications only from merchants who are serious about conducting business.

- While collecting initial contact information of the Merchant's lead, the form acts as an indicator of the kind of information we will require him to provide.

- It helps Merchant create a mental checklist of KYC and Business information evidence we will eventually ask him to provide.

The information points requested from the prospective merchant helps us screen the merchant at this level itself. The idea is to solicit applications only from merchants who are serious about conducting business.

Close

Onboarding Processes

The various teams perform specific tasks for onboarding the merchant.

Evaluation and approval: Basic clarification / closing information gaps

and taking decisions on payment options to be offered to the merchant

Follow up documentation and activation of account

Final scrutiny and approval

Ensuring all physical documents are digitized and securely stored with

multiple backups and with easy access provided to merchant operations & legal teams.

Assessment of the complete risk profile based on various factors such as

Business fileing status, LOB, MCC, and transaction verification.

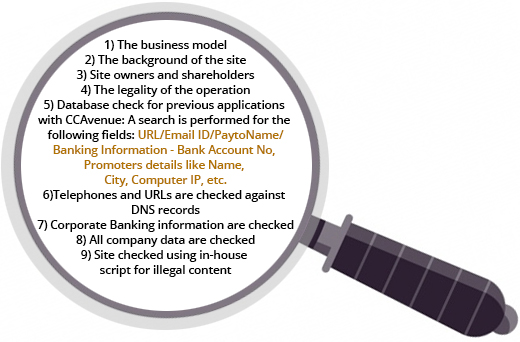

Approval Process

- Signup details are evaluated;

- Scrutiny Areas: Domain check, website evaluation, product categories as well as investigation of online reputation etc.

- Verification of the phone numbers / address is also performed so as to ensure the information received is genuine.

- Any clarifications / changes / revisions required in the Application Form are communicated to the merchant.

Close

Activation Process

Upon approval from the merchant underwriting team, the merchant operations team follows up

for the documentation to complete merchant activation.

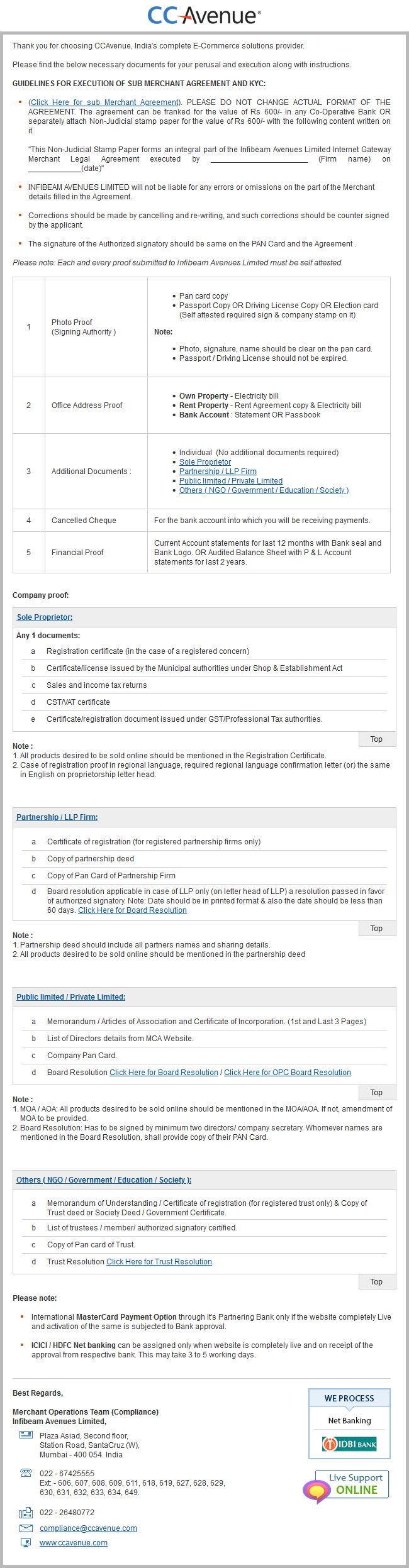

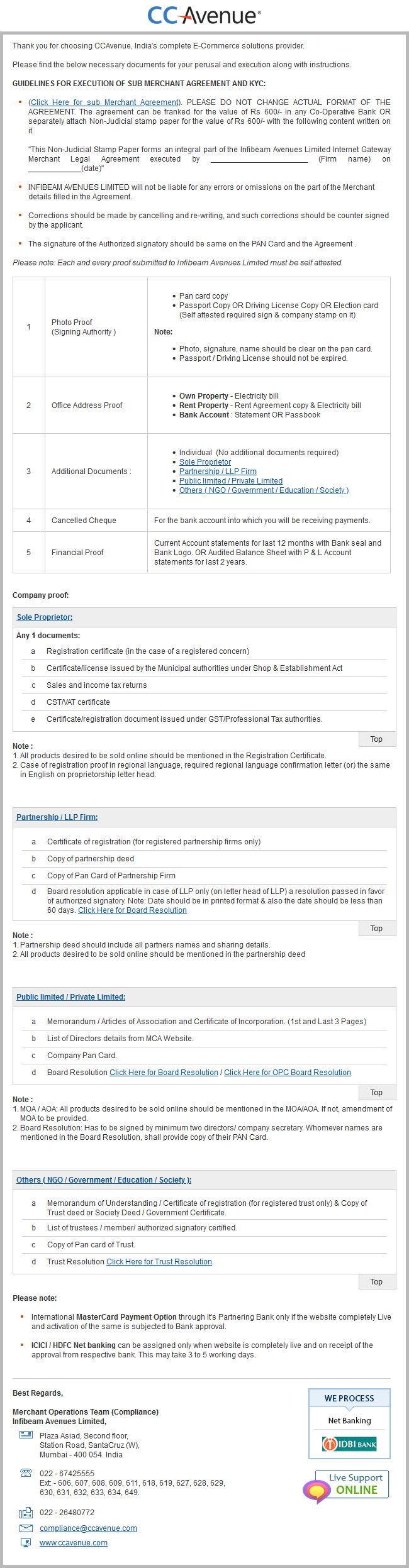

Documentation Requirements

A. Signing a legal agreement and the legal agreement franked for the value of Rs 600/- OR separately attach Non-Judicial stamp paper for the value of Rs 600/- with the following content written on it

"This Non-Judicial Stamp Paper forms an integral part of the Infibeam Avenues Ltd. Internet Gateway Merchant Legal Agreement executed by ______________________ (name) on ____________(date)"

B. Submission of business entity documents: These documents are required to be duly authenticated and signed as true copy by the Authorized Personnel. Following the initial investigation stages, supporting documents will be requested from the merchant. These documents will be required to support the details that were either provided in the initial application, or that were formulated in the course of the initial assessment.

To summarize, the Merchant Operations Team requires the following documentation from the merchant:

Documentation Requirements

A. Signing a legal agreement and the legal agreement franked for the value of Rs 600/- OR separately attach Non-Judicial stamp paper for the value of Rs 600/- with the following content written on it

"This Non-Judicial Stamp Paper forms an integral part of the Infibeam Avenues Ltd. Internet Gateway Merchant Legal Agreement executed by ______________________ (name) on ____________(date)"

B. Submission of business entity documents: These documents are required to be duly authenticated and signed as true copy by the Authorized Personnel. Following the initial investigation stages, supporting documents will be requested from the merchant. These documents will be required to support the details that were either provided in the initial application, or that were formulated in the course of the initial assessment.

- Applicant's identity

- Business address

- Legal status

- Address verifications and, crucially, previous processing background.

To summarize, the Merchant Operations Team requires the following documentation from the merchant:

- A legal agreement document generated by CCAvenue duly signed and stamped by the Merchant in a legally valid document format.

- Detailed KYC of the merchant: To ensure that the individual requesting for the PG Services is a legitimate individual, certain key identity documents are requested such as Passport, Voter's Identity Card, Driving License and PAN Card.

- Key business related documents: To ensure that the merchant's business is a legitimate one and that he has the necessary documents that meet the standards of the KYC norms of the organization and the financial ecosystem, we have set a process of collection and close scrutiny of the merchant's business related documents.

Close

Final Scrutiny & Approval

Upon receiving the go-ahead from the Merchant Operations Team on satisfactory completion of

the documentation process, the Legal Team steps in for the final scrutiny and approval

stage.

- The Legal Team executes a second-level check of all documents and legal agreements.

- If information gaps or inconsistencies are found, they refer the documentation back to the Merchant Operations Team for revision.

- If everything checks out fine, the Legal Team forwards the documents for the Final Audit to the Merchant Operations Team for submitting the details to the Nodal Bank.

- Post the collection of documents, the merchant details sent for audit are re-verified by the Risk Team based on the Line of business, BFS, Location and transaction verification.

Close

Activation of the Merchant Account

- After the final go-ahead is received from the Legal Team, the Merchant Operations Team gets the account activated i.e. The Payment Gateway Integration Kit is sent to the merchant in an auto generated Activation Mail.

- Merchant can now Integrate with CCAvenue & start processing transactions upon successful integration.

- The CCAvenue System is updated with the Merchant Information and Bank Details, while the business rules are implemented.

- Further based on the Risk Profile of the merchants i.e based on the Line of business, BFS, location and transaction verification, the merchants are categorized as 'High Risk' and 'Low Risk' merchants and their activities monitored accordingly.

INFIBEAM AVENUES

INFIBEAM AVENUES