CCAvenue Payment Links: Making payments possible, with the click of a link

Digitization is playing a significant role in transforming a predominantly cash-dependent Indian economy into a cashless economy. This shift has created a need for simple and hassle-free means of digital payments for businesses of all sizes and nature. Small merchants, entrepreneurs, home-based businesses etc. accepting payments via cash, having no website or online store should be able to collect and manage digital payments with as much ease as any online business. However, most of them do not have the technical expertise required to set up an online business and accept digital payments. The simplest way to do this, without any developer resources or investment in payment infrastructure is with CCAvenue Payment Link.

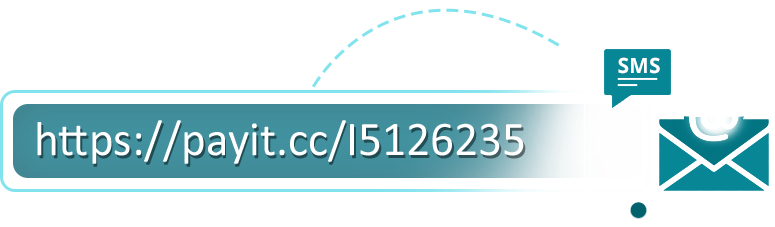

Unlike a normal link, Payment Link is a request for payment through a securely generated web link/url which customers can click to make online payments instantly. This link can be shared across various communication channels like Email, SMS, social media, etc. and the payment fulfillment is easy and flexible for both sellers and their customers.

A seller can receive payments via CCAvenue Payments Link in three simple steps:

Create Link

Create individual payment link or bulk upload links via APIs or dashboard with the flexibility to manage details like amount, receipt number, validity, etc.

Share Link

Share the payment link with the customer across several platforms like SMS, email, social media etc. and collect payments instantly.

Get instant payments

Complete the payment with a plethora of payment modes like Credit Card, Debit Card, Net banking, Wallet, UPI and many more offered by CCAvenue.

CCAvenue offers a customized dashboard to manage links, track the payment status, and get real-time insights to manage payments and business better. Sellers can stay informed on the status of the payment via webhook alerts through our Dynamic Event Notifications. Payments links effortlessly connects into the business ecosystems and is perfectly suited for both online as well as offline businesses. A few use cases where payment links can be a perfect fit:

- Small Businesses: For small or home-based businesses that do not have an app or a website, payment links is the best and the easiest way to start accepting online payments.

- Social Media Businesses: Run a business on social network and monetize the platform. Payment links can be shared easily over many social networks such as Facebook, Twitter, Instagram, WhatsApp etc., offering your customers a quick checkout option.

- Alternate Payments: Payment links are an effective option for cash-on-delivery, point-of-sale or following up on abandoned carts etc.

- Utility Bill Payments: Payment collection for utility bills and similar services such as telephone, gas, electricity bills and insurance premium can be done by billers through payment links.

- Customised Payments: Merchants can utilize payment links to offer special discounts on bulk purchases to select customers or accept adhoc payments outside of their shopping carts for one-time services such as cloth alteration, customized packaging and warranty extensions.

Payment Links can also be seamlessly embedded into CCAvenue Invoices, a solution for efficient and streamlined billing.

Collecting online payments cannot get easier that this!

INFIBEAM AVENUES

INFIBEAM AVENUES