What is Tokenisation?

What is Tokenisation?

Tokenisation is the process of substituting the 16-digit

sensitive static card number / original Primary Account Number (PAN) with a unique

irreversible

digital identifier known as a 'Token'. Tokenisation helps in strengthening security and

allows

customers to store their card details in a secure and compliant manner without compromising

their sensitive data. Tokens further reduces the risk and impact of card data leaks and

fraudulent activity.

What is the recent RBI guideline on card storage?

What is the recent RBI guideline on card storage?

The recent RBI guideline on Card-On-File Tokenisation (CoFT) (circular

No. CO.DPSS.POLC.No.S-516/02-14-003/2021-22 dated 7th September 2021) prohibits online

merchants, acquiring banks, and payment gateways/aggregators from storing customer card

information on their servers. With effect from 1st January 2022, Card Networks and Card

Issuers

are the only entities permitted to store customers' card data and issue unique irreversible

tokens to ensure secure encryption of the card information.

What is CCAvenue TokenPay?

What is CCAvenue TokenPay?

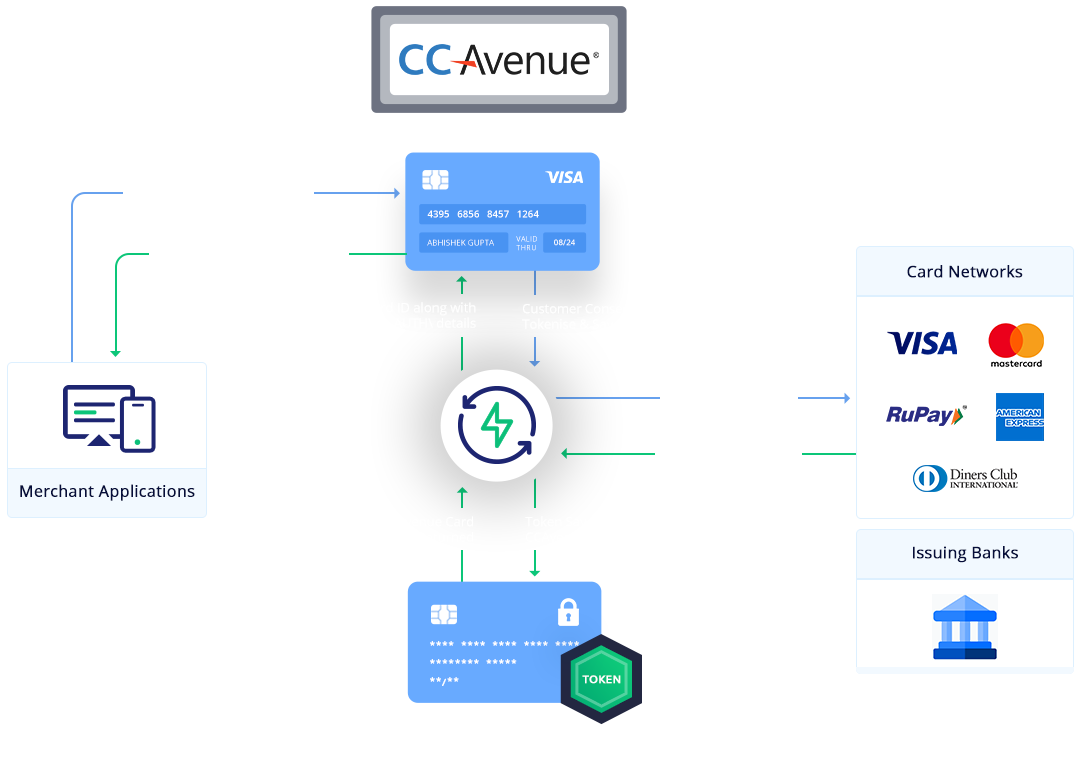

CCAvenue TokenPay is an end-to-end solution for merchants to allow

their customers to continue saving cards via network issued tokens in compliance with RBI

recommended framework. It is a multi-network tokenisation solution, which enables token

provisioning, token retrieval, token management and token processing through a unified

platform

without multiple integration.

Why should businesses opt for CCAvenue TokenPay?

Why should businesses opt for CCAvenue TokenPay?

Businesses must opt for CCAvenue TokenPay to continue offering a quick

checkout experience to their customers by converting their saved cards into secure network

issued tokens as mandated by RBI. However, post 31st Dec 2021, businesses who have not

implemented the tokenisation solution will no longer be able to offer a saved card

experience on

their checkout pages. Customers will have to enter complete card information for every

transaction leading to poor user experience, lower conversions due to abandoned carts and

failure due to errors in manual card data inputs.

Who can save cards as per the new guidelines?

Who can save cards as per the new guidelines?

As per the recent RBI guideline, Card networks & Card issuers are the

only entities allowed to store customers' card data. Payment aggregators, payment gateways,

acquiring banks and merchants can now only store a tokenized card.

Can businesses store Tokens instead of Cards?

Can businesses store Tokens instead of Cards?

Merchants who are using CCAvenue Vault to save their cards, can

continue the same the tokens generated for the vault as before. However only PCI DSS

compliant

Merchants can store Network Tokens.

Will a token created for a customer card be unique for a

business?

Will a token created for a customer card be unique for a

business?

Yes, a token created for a customer card will always be unique to a

business. A token generated on one merchant's website / app cannot be used on another

merchant's

website / app. This means, one customers' card will have multiple tokens

generated for different businesses.

Is customer consent required for saving or creating a token?

Is customer consent required for saving or creating a token?

Yes, customer consent and an additional factor of authentication (AFA)

is required for saving or creating a token.

Who can be a Token Requestor?

Who can be a Token Requestor?

CCAvenue can become a Token Requestor for a merchant. Merchants will

integrate with CCAvenue TokenPay and CCAvenue would be integrating with all the networks

(Visa,

Mastercard, RuPay, American Express & Diners).

A business can also become a Token Requestor but they must be PCI DSS compliant and must

undergo

periodic audits. If a business wishes to connect directly to the networks as a Token

Requestor,

it entails integration and certification with each individual network. CCAvenue TokenPay can

ease this process for the businesses by provisioning multi-network tokens through a single

integration.

What are the benefits of tokenisation?

What are the benefits of tokenisation?

- Protects customer's card data and strengthens payment security.

- Minimizes the risk of card data leaks & frauds significantly with merchant specific

unique irreversible Tokens.

- Enhances the user experience by offering the saved card checkout through secure

tokens.

- Improves conversions by reducing abandoned carts and failure due to errors in manual

card data inputs.

What information can businesses continue to store and display

to the customers?

What information can businesses continue to store and display

to the customers?

Businesses can continue to store the last 4 digits of the actual card

number and issuing bank name. The same will be displayed to the customers.

How will tokenisation affect the customer checkout experience?

How will tokenisation affect the customer checkout experience?

The customer checkout experience will have minimal impact. All

customers who have given consent to tokenise their cards will continue to have a seamless

saved-card checkout experience by entering only their CVV. However, customers who choose not

to

tokenise their card, must manually enter their payment card information for every

transaction.

Can CCAvenue issued tokens be used to process payments via

other payment systems?

Can CCAvenue issued tokens be used to process payments via

other payment systems?

Yes, CCAvenue issued tokens can be used to process payments across

multiple Payment systems without any hassle. If a Business wishes to use CCAvenue to

provision

tokens for processing on other payment gateways this is also possible, but then the business

must mandatorily be PCI compliant and must perform prescribed security audits. Also they

would

need to incorporate additional transaction level api calls for runtime security parameters.

What integration changes are required to be done as a CCAvenue

merchant?

What integration changes are required to be done as a CCAvenue

merchant?

Businesses using CCAvenue Payment Page, CCAvenue iFrame and Customised Checkout Pages

can

enable tokenisation without

any integration effort. CCAvenue TokenPay has been auto-enabled for these businesses.

Merchants using seamless APIs for payment processing or recurring payments or CCAvenue

vault

can continue to use the

current apis for and the network tokenisation for saved cards will be seamlessly handled

at

the CCAvenue end.