Competitors In Payment Gateway Business Are Committing Harakiri: Mohan Nair, CCAvenue

Published by Medianama | 29th January, 2014 - Mumbai, India

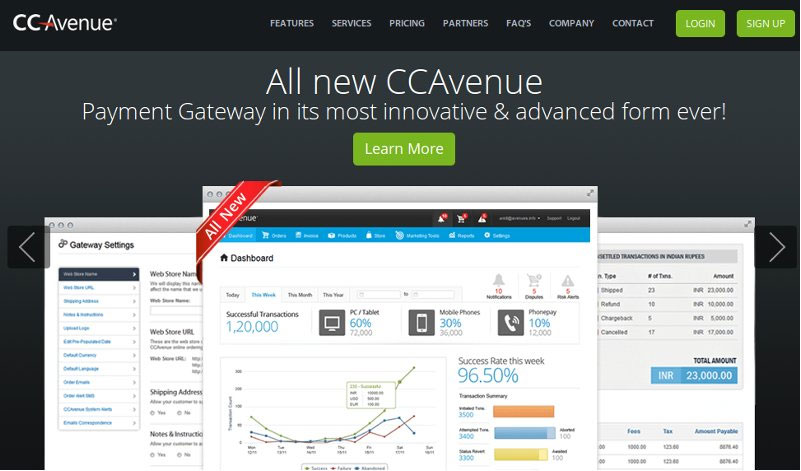

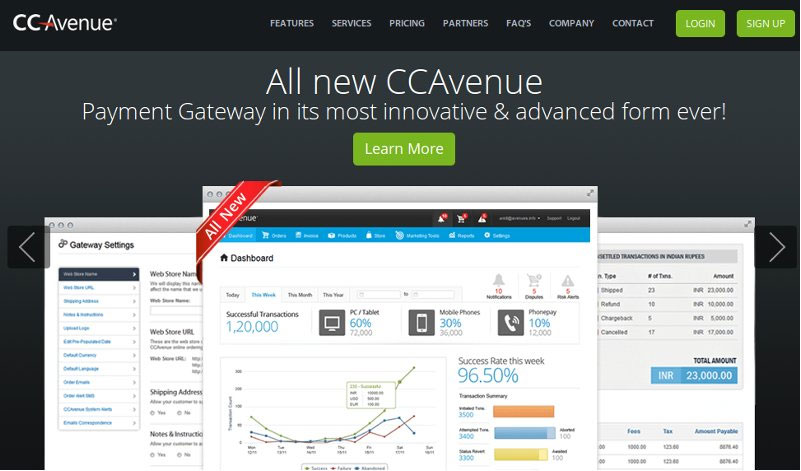

Earlier this week, CCAvenue* did a reboot from being a vanilla payment gateway to a service suite offering a Do-It-Yourself Webstore, with analytics and marketing solution, reputation monitoring and 1-click checkout among other features. The company's CMO Mohan Nair spoke to MediaNama about this shift and said that the payment gateway marketplace is too crowded now, with every new player trying to elbow each other out for the same merchants instead of concentrating on the fast growing e-commerce space. Nair accused many "desperate VC-funded companies" and "newbies" of dropping rates in a cut throat manner to show results. He also said that CCAvenue has no plans to launch a wallet as they want to remain merchant neutral. He added that the company is a "customer convenience" platform, while others are doing it as a "customer acquisition" platform.

New business strategy:

Neither has it remained a pure-play vanilla payment gateway nor has it become a full scale solutions provider to the level that other companies have evolved to be. I would say that the market is evolving at a rapid pace and demand from merchants on market enhancing features, both in the terms of new product offering and technology robustness, is on the rise.

Market has evolved, aspirations from merchants are also evolving, competition is also offering unique products. So we thought we shouldn't remain just a vanilla payment gateway. We already had a head start over the others being a serious players who cater to 85% of the players. We are what you call influential in this space

We spent 2 years working on this and we spent a lot of man hours in design and technical details for the multi-currency payment which we call the New CCAvenue. And this is a product that was built only after receiving feedback from vertical players - education, retail, recharge, across the board.

Logic behind the shift

We have been fortunate to have powered 85% of e-commerce players across various verticals and received vertical specific feedback from them. We keep getting customised requests to ensure that our payment gateway and merchant acquisition process complements their process. This has helped us design a completely new process and end user interface.

There is a growing rate of 40-45% at which online payment e-commerce is growing and with that kind of scale, payment gateways need not only scalability, but also the fact that end users need to have a better UX and UI.

On the other hand we receive 150-200 sign-ups a day and we noticed that 65-70% are new startups. So we needed easy entry and in a low cost as well as as very advanced payment gateway. Just because we charge less at entry level, we cannot offer them less. People want... I would use the term, quality product at a reasonable price, not a premium one at premium price.

The popular scheme now with CCAvenue is zero fees; you can come in and there is no set up fee involved and even TDRs per transaction fee is also rationalised hoping that we will be inline with competition not far away. At the same time we will be able to widen our existing set of merchants and get more volumes from them.

How have volumes changed

Since we launched our economy scheme in September 2012, our daily sign-ups have increased 35-40% due to which our daily transaction volumes have also increased to 20-25%.

Why offer 27 currencies?

We are the ones who have been talking about multi-currencies for a long time. Other than the CCAvenue India offering, we also had something called CCAvenue World that caters to payments outside of India to Mauritius etc. But those are extremely costly and is very cumbersome. So we thought why not address Indian business that are now looking to cater to global audience and not just NRI community. Offering multiple currencies will allow buyers localised experience while giving the merchant global reach.

More importantly issues related to currency conversion; even in international payment gateways, currency conversion is a tacky issue. Issues of currency conversion is avoided in this because while a person is comfortable paying in Pounds (GBP), the merchant receiving the payment during the transaction does so in Rupees. So to summarise, this helps reach target market and helps end customer make payments in a currency he is most comfortable with and knows best.

On the exchange rate

We don't have any extra conversion rate; that is handled by the banks. We don't have any say in that.

Importance of dispute resolution

If you go to our system and check the new system, we have added dispute resolution. When there is a dispute between customer and merchant and if it gets escalated to the bank level, you can be dead sure that the customer is going to be unhappy with the merchant and the merchant is going to lose confidence in us even though we have no role to play in it. So what we have done is, to make this a triple win. We have started dispute resolution on the platform and we will try to resolve the disputes between merchant and customer before it gets escalated to the bank one way or the other.

We have a risk management team that will also take care of disputes. Once we crack the risk and resolve the dispute, then we can get both parties to agree to some solution. A lot of people want to do the 1 click thing, but there are certain things CCAvenue will do, we won't do and will only do in a way that suits our business goals.

Won't do wallets

These days you find wallets being one of the major things people are offering. This is something we are not going into and we have not even applied for an RBI license for wallets very consciously. We see to it that merchants are focussing on customers rather than us. We don't want to acquire customer's funds and we want to be seen as neutral. We want to be the third-party in the transaction rather than the person who holds the customer's money and then channels it in. Our way of doing business is that we align and do white label with banks to ensure that customers of banks are taken as focus audience rather than, you know, playing around customers of different brands.

Monetisation

Existing guys on old platform are being actively shifted to the new one free of cost. Other than that, where we are sourcing customer is we have a popular scheme where they can come in free, but transaction rates are slightly higher. These are good for startups who don't have capital to invest and whose volumes are low and sporadic to begin with. So they don't mind paying a little bit of a higher transaction rate. This is to test their business from an online perspective. Once their volumes picks up, they are free to shift to higher plans where they will probably be wiling to pay a higher one time fee and lower per transaction fee. That makes business sense to them. Are we making money out of this payment gateway? Yes, we are.

The new e-commerce offering is free. We want to slowly move from a payment gateway to a complete e-commerce suite. But while being a complete e-commerce suite, we want to be merchant centric and we want to be merchant neutral. This is very very clear. We will always remain merchant centric and merchant neutral.

All these products will be free as of now, but not necessarily in the future. We will see how the market accepts it. If there is an opportunity to monetise it, then we might consider.

On margins

There is a cost involved in offering such technology and each upgrade or feature will cost company in terms of headcount and tech. This is something we are willing to bear for now in the hope that this will strengthen our franchise.

This new platform has take us 2 years to build and we have a team of 30 people dedicated just to this. Now what is happening is that competition has increased and these newbies are trying to jostle their space in the existing market instead of expanding into the hugely potential e-commerce market. Rates are being dropped in a cut throat manner and the term undercutting has become a reality. We are doing this because desperate VC-funded companies are wiling to go to any extent to show results.

This is one side, the other side is that RBI mandate on prescribing the end merchant rates MDR, TDR, without us being allowed us to put a markup is hurting the aggregator. This is not practiced anywhere else in the world and has not helped us. And with competition it is getting more crowded and murkier jostling for share and rates are being dropped and that is creating pressure on us.

Being merchant neutral

Being merchant neutral, we are a customer convenience platform, while others are doing 1Click as a "customer acquisition" platform. CCAvenue has therefore made it clear that they don't want to get into a situation of getting customers and turning them elsewhere like other newbies are doing. We are doing it for speedy transaction, better customer retention for the merchant and it encourages repeat purchases.

You will find certain competitors of ours, because they are part of a certain group, are not entertained by the travel vertical for instance. We don't want to be in such a situation where we are seen aligned with particular brand or merchant. Within our group as such, we don't have any business that is in contradiction with our key merchants. That is why as a self funded, non-VC funded company, being in existence as a going concern since the past 10 years, we have always maintained equi-distance from everyone. People are coming to us from funding and alliance perspective, but we have not done that consciously.

Crowded marketplace

It has become extremely crowded; in fact everyone's jostling for space. Rather than looking at e-commerce that is growing at a rate where people should be looking at expanding the payment gateway market, undercutting is happening and people are trying to elbow one another from existing merchants. As market leaders we are bearing the brunt, but we have been able to safeguard most of our turf and with this product, we are very sure we will not only find and keep, but also win.

How long before dust settles down?

I can't put a finger on this, but there will be a shakeout sooner or later. As long as there is VC funding and people are desperate to show numbers, they will do anything. They will embrace all kinds of practices and there are certain practises we won't do.

I think it'll follow the same curve (as e-commerce companies), how certain companies came and then lifecycles were cut short. But what is happening is, there are so many retail players starting their own payment gateways. You have to see that starting a payment gateway has its own complexity in India, but we feel that is still a better option than those who start payment gateway and do under cutting across the board. For us that doesn't make sense. If you ask us, they are committing harakiri.

New business strategy:

Neither has it remained a pure-play vanilla payment gateway nor has it become a full scale solutions provider to the level that other companies have evolved to be. I would say that the market is evolving at a rapid pace and demand from merchants on market enhancing features, both in the terms of new product offering and technology robustness, is on the rise.

Market has evolved, aspirations from merchants are also evolving, competition is also offering unique products. So we thought we shouldn't remain just a vanilla payment gateway. We already had a head start over the others being a serious players who cater to 85% of the players. We are what you call influential in this space

We spent 2 years working on this and we spent a lot of man hours in design and technical details for the multi-currency payment which we call the New CCAvenue. And this is a product that was built only after receiving feedback from vertical players - education, retail, recharge, across the board.

Logic behind the shift

We have been fortunate to have powered 85% of e-commerce players across various verticals and received vertical specific feedback from them. We keep getting customised requests to ensure that our payment gateway and merchant acquisition process complements their process. This has helped us design a completely new process and end user interface.

There is a growing rate of 40-45% at which online payment e-commerce is growing and with that kind of scale, payment gateways need not only scalability, but also the fact that end users need to have a better UX and UI.

On the other hand we receive 150-200 sign-ups a day and we noticed that 65-70% are new startups. So we needed easy entry and in a low cost as well as as very advanced payment gateway. Just because we charge less at entry level, we cannot offer them less. People want... I would use the term, quality product at a reasonable price, not a premium one at premium price.

The popular scheme now with CCAvenue is zero fees; you can come in and there is no set up fee involved and even TDRs per transaction fee is also rationalised hoping that we will be inline with competition not far away. At the same time we will be able to widen our existing set of merchants and get more volumes from them.

How have volumes changed

Since we launched our economy scheme in September 2012, our daily sign-ups have increased 35-40% due to which our daily transaction volumes have also increased to 20-25%.

Why offer 27 currencies?

We are the ones who have been talking about multi-currencies for a long time. Other than the CCAvenue India offering, we also had something called CCAvenue World that caters to payments outside of India to Mauritius etc. But those are extremely costly and is very cumbersome. So we thought why not address Indian business that are now looking to cater to global audience and not just NRI community. Offering multiple currencies will allow buyers localised experience while giving the merchant global reach.

More importantly issues related to currency conversion; even in international payment gateways, currency conversion is a tacky issue. Issues of currency conversion is avoided in this because while a person is comfortable paying in Pounds (GBP), the merchant receiving the payment during the transaction does so in Rupees. So to summarise, this helps reach target market and helps end customer make payments in a currency he is most comfortable with and knows best.

On the exchange rate

We don't have any extra conversion rate; that is handled by the banks. We don't have any say in that.

Importance of dispute resolution

If you go to our system and check the new system, we have added dispute resolution. When there is a dispute between customer and merchant and if it gets escalated to the bank level, you can be dead sure that the customer is going to be unhappy with the merchant and the merchant is going to lose confidence in us even though we have no role to play in it. So what we have done is, to make this a triple win. We have started dispute resolution on the platform and we will try to resolve the disputes between merchant and customer before it gets escalated to the bank one way or the other.

We have a risk management team that will also take care of disputes. Once we crack the risk and resolve the dispute, then we can get both parties to agree to some solution. A lot of people want to do the 1 click thing, but there are certain things CCAvenue will do, we won't do and will only do in a way that suits our business goals.

Won't do wallets

These days you find wallets being one of the major things people are offering. This is something we are not going into and we have not even applied for an RBI license for wallets very consciously. We see to it that merchants are focussing on customers rather than us. We don't want to acquire customer's funds and we want to be seen as neutral. We want to be the third-party in the transaction rather than the person who holds the customer's money and then channels it in. Our way of doing business is that we align and do white label with banks to ensure that customers of banks are taken as focus audience rather than, you know, playing around customers of different brands.

Monetisation

Existing guys on old platform are being actively shifted to the new one free of cost. Other than that, where we are sourcing customer is we have a popular scheme where they can come in free, but transaction rates are slightly higher. These are good for startups who don't have capital to invest and whose volumes are low and sporadic to begin with. So they don't mind paying a little bit of a higher transaction rate. This is to test their business from an online perspective. Once their volumes picks up, they are free to shift to higher plans where they will probably be wiling to pay a higher one time fee and lower per transaction fee. That makes business sense to them. Are we making money out of this payment gateway? Yes, we are.

The new e-commerce offering is free. We want to slowly move from a payment gateway to a complete e-commerce suite. But while being a complete e-commerce suite, we want to be merchant centric and we want to be merchant neutral. This is very very clear. We will always remain merchant centric and merchant neutral.

All these products will be free as of now, but not necessarily in the future. We will see how the market accepts it. If there is an opportunity to monetise it, then we might consider.

On margins

There is a cost involved in offering such technology and each upgrade or feature will cost company in terms of headcount and tech. This is something we are willing to bear for now in the hope that this will strengthen our franchise.

This new platform has take us 2 years to build and we have a team of 30 people dedicated just to this. Now what is happening is that competition has increased and these newbies are trying to jostle their space in the existing market instead of expanding into the hugely potential e-commerce market. Rates are being dropped in a cut throat manner and the term undercutting has become a reality. We are doing this because desperate VC-funded companies are wiling to go to any extent to show results.

This is one side, the other side is that RBI mandate on prescribing the end merchant rates MDR, TDR, without us being allowed us to put a markup is hurting the aggregator. This is not practiced anywhere else in the world and has not helped us. And with competition it is getting more crowded and murkier jostling for share and rates are being dropped and that is creating pressure on us.

Being merchant neutral

Being merchant neutral, we are a customer convenience platform, while others are doing 1Click as a "customer acquisition" platform. CCAvenue has therefore made it clear that they don't want to get into a situation of getting customers and turning them elsewhere like other newbies are doing. We are doing it for speedy transaction, better customer retention for the merchant and it encourages repeat purchases.

You will find certain competitors of ours, because they are part of a certain group, are not entertained by the travel vertical for instance. We don't want to be in such a situation where we are seen aligned with particular brand or merchant. Within our group as such, we don't have any business that is in contradiction with our key merchants. That is why as a self funded, non-VC funded company, being in existence as a going concern since the past 10 years, we have always maintained equi-distance from everyone. People are coming to us from funding and alliance perspective, but we have not done that consciously.

Crowded marketplace

It has become extremely crowded; in fact everyone's jostling for space. Rather than looking at e-commerce that is growing at a rate where people should be looking at expanding the payment gateway market, undercutting is happening and people are trying to elbow one another from existing merchants. As market leaders we are bearing the brunt, but we have been able to safeguard most of our turf and with this product, we are very sure we will not only find and keep, but also win.

How long before dust settles down?

I can't put a finger on this, but there will be a shakeout sooner or later. As long as there is VC funding and people are desperate to show numbers, they will do anything. They will embrace all kinds of practices and there are certain practises we won't do.

I think it'll follow the same curve (as e-commerce companies), how certain companies came and then lifecycles were cut short. But what is happening is, there are so many retail players starting their own payment gateways. You have to see that starting a payment gateway has its own complexity in India, but we feel that is still a better option than those who start payment gateway and do under cutting across the board. For us that doesn't make sense. If you ask us, they are committing harakiri.

INFIBEAM AVENUES

INFIBEAM AVENUES