CCAvenue Now Enables UPI Payments Through The Intent Flow Via UPI Supported Apps

|

|

|

UPI has been a game changer for the Indian payment ecosystem and we at CCAvenue strongly believe that UPI is the future of payments in India. We had launched UPI acceptance for businesses and have been offering P2M payments (customer to merchant) on UPI since 2016. The conventional UPI collect flow, allows bank account holders to transact using a Virtual Payment Address (VPA), without entering additional bank information.

CCAvenue now announces the new UPI Intent flow for payments on native mobile applications using existing UPI supported apps installed on their phones like Phonepe, Whatsapp, BHIM, Tez etc., thereby avoiding the need to use multiple apps (merchant, SMS, UPI app) for payments.

|

|

|

|

|

|

|

SECRET TECHNIQUES TO GROW YOUR ONLINE BUSINESS AND ACHIEVE SUCCESS

|

|

The total revenue from the Indian eCommerce market has already touched US$22,138m in the year 2018. This figure is expected to grow at the rate of 19.8% (CAGR 2018-2022), leading to a market volume of US$45,550m by 2022. Online businesses are now offering a wide range of products and services including shopping items, groceries, restaurant orders and more. Nearly 54% of startups enter the Indian market every year since going online can be a profitable venture for many businesses in the country.

Even though there are thousands of opportunities for startups in the e-commerce space, not every online business is likely to find huge success and significant growth in their respective areas of business. After having analyzed the success stories of various marketing organizations, we finally discovered certain core aspects that contributed to the success of most of the e-commerce firms.

|

|

|

|

|

|

|

DIGITAL PAYMENT TECHNOLOGY - ENHANCING CUSTOMER'S CONFIDENCE IN ONLINE PAYMENTS

|

|

Online shopping and its supporting technologies have evolved rapidly over the past few years helping the eCommerce industry thrive in the middle of cut-throat competition. Its credit goes to the millions of digital savvy customers who have set their preferences to digital payments, a combined solution that gives maximum comfort and security. From 'brick-and-mortar' stores, customers have moved over to the type of online shopping that features instantaneous and automated payments. As a result of the remarkable increase in digital payments, India is estimated to have online payments worth approximately $500 billion by 2020, as cited in a report published by Google - Boston Consulting Group. Payment service providers and financial institutions are therefore adapting to the best form of digital transactions that can enhance the customer's experience.

|

|

|

|

|

|

|

INDUSTRY NEWS

|

|

|

WHATSAPP PAYMENTS IS BUILT ON FB PLATFORM, SAYS PRIVACY WILL BE PROTECTED

Source: Medianama

WhatsApp has updated its payments privacy policy and has ensured that the parent company Facebook will not store any data pertaining to payments.

Read More

|

|

| |

|

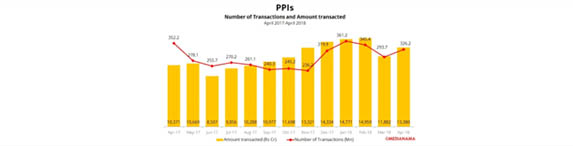

TRANSACTIONS ON MOBILE WALLETS REBOUND SLIGHTLY TO 279.3M IN APRIL 2018

Source: Medianama

Amount transacted using Mobile Wallets increased 16% to Rs 11,695 crores from Rs 10,097 crores and grew 57% year on year from Rs 7,442 crores in April 2017.

Read More

|

|

| |

|

MYNTRA VS AMAZON FASHION: WHO WON THE FASHION SALE WAR?

Source: inc42

Fashion continues to be a major game-changer for the leaders of Indian eCommerce like Amazon and Flipkart, along with the latter's subsidiaries Myntra and Jabong.

Read More

|

|

| |

|

HOW CAN UPI HELP TO TAKE FINTECH TO THE MASSES?

Source: inc42

The mobile revolution along with easy access to internet across the country drove mobile businesses such as e-commerce. Naturally a need for digital payments was felt.

Read More

|

|

| |

|

|

|

Disclaimer: We do not claim ownership over the images / articles appearing in the Industry News section. They are used for information purposes only and in no way are meant to claim ownership over any of the above mentioned. All photos, videos, articles, etc. are copyrighted to their original owners.

|

|

|

|