Leverage CCAvenue's Feature-Rich Platform to Grow Your Business in 2020

|

Finding the most apt payment solutions that support your unique business model can be quite challenging especially in the rapidly expanding Indian e-commerce space. CCAvenue offers a range of advanced solutions to its web merchants that enable them to accept payments securely as well as enhance their business potential. Our payment platform caters to the specific needs of all kinds of businesses across industry verticals including e-retail, real estate, travel and hospitality, healthcare, government agencies, job portals, education, and more. For the upcoming year 2020, our merchant partners can choose from a wide range of business enhancement features to make the most of the opportunities that come their way.

|

|

CCAvenue B2Biz

Streamline & automate your business collections and payments with our NextGen B2B payment platform.

|

|

|

CCAvenue S.N.I.P.

Our innovative social commerce facility enables you to directly sell and collect payments in-stream from your business pages on leading social media networks.

|

In-App Payments

Our In-App Payments enables you to accept payments directly through your Android, iOS or Windows applications.

|

|

|

Payment Links

Request for payments through a securely generated payment link shared via Email, sms, social media, etc. and get paid right away.

|

Invoice Payments

You can instantly create and send invoices to your customers by emailor SMS with a click- to-pay button and collect payments faster.

|

|

|

Advanced Marketing Tools

Enhance your marketing and sales efforts more customers and earn more by showcasing offers and promotions on your website.

|

Subscriptions

Create subscription plans that best suit your business model and collect recurring as well as standaline multiple payment modes.

|

|

|

PhonePay

CCAvenue PhonePay is our fully hosted IVR Solution that provides a secure and user-friendly Interactive Voice Response (IVR) payment system for customers who prefer paying over the phone.

|

|

|

|

CCAvenue Declared 'Best Online Technology Provider' at the BFSI Smart Tech Leadership Awards 2019

|

|

|

Having gained competitive advantage in the digital payments industry for its effective use of cutting-edge payment technologies, CCAvenue has been adjudged the 'Best Online Technology Provider' at BFSI Smart Tech Leadership Awards 2019. Mr. Pranjal Pandey and Ms. Neeta Kapoor, the regional managers (Marketing), accepted the award on behalf of the company at the ceremony organized by Kamikaze B2B Media in New Delhi on 10th December 2019. The BFSI Smart Tech Leadership Awards seeks to recognize the major players in the BFSI sector which have developed the latest technologies to stay ahead of the curve. CCAvenue has pushed far beyond any known boundaries of PG software engineering in India to upgrade its payment processing platform for the benefit of its merchant partners. Our platform incorporates the latest payment technologies to offer payment gateway services with advanced features that redefine user experience, improve transaction success rates and increase the earning potential of Indian eCommerce websites.

|

|

|

|

|

|

|

Infibeam Avenues secures 'Best Workplace of the Year' accolade at the Employee Experience & Engagement Awards 2019

|

|

|

With an aim to augment the revenue stream of its enormous merchant base, CCAvenue, Infibeam Avenues' multi-channel payment platform, now offers Bank of Baroda's EMI facility in its Multi Bank EMI offering. The inclusion of this new payment option will further consolidate the existing card-based EMI payment feature, enabling 1.2 lakh+ eCommerce websites powered by CCAvenue to maximize revenue and grow their businesses considerably. CCAvenue is already the provider of maximum EMI options in the country, offering the EMI facilities of 15 leading banks.

|

|

|

|

|

|

|

INDUSTRY NEWS

|

|

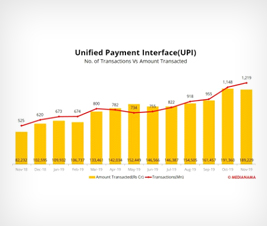

Number of UPI transactions grew by 6% to 1.22 billion in Nov 2019

Source: Medianama

Unified Payment Interface (UPI) saw an increase of 6% in total transaction volumes between October...

Read More

|

|

|

| |

|

Government likely to bring new e-commerce policy in FY20

Source: Livemint

The government may bring the e-commerce policy in the current fiscal though no timeline...

Read More

|

|

| |

Inside digital payments and what's

Source: livemint

The Reserve Bank of India said it proposed to introduce a pre-paid instrument with a spending limit of 10,000....

Read More

|

|

|

| |

|

India sets banks target of 45 Bn digital transactions by 2020

Source: Inc42

The Ministry of Electronics and Information Technology (MeitY) sent a letter to banks and payments firms...

Read More

|

|

| |

|

|

|

Disclaimer: We do not claim ownership over the images / articles appearing in the Industry News section. They are used for information purposes only and in no way are meant to claim ownership over any of the above mentioned. All photos, videos, articles, etc. are copyrighted to their original owners.

|

|

|

|