CCAvenue Payment Links Making payments possible, with the click of a link

|

|

Managing your business collections and payments can be a big challenge. Your business can face issues such as high cost of cash management, trouble in reconciliation for part payments, high admin cost for manual reconciliation and delayed payment realization. CCAvenue B2Biz, the Next-Gen Automated B2B Payment Platform, enables collections and payments for businesses instantly via multiple payment modes including NEFT, RTGS and IMPS. CCAvenue B2Biz automates and streamlines Accounts Payables & Receivables, optimizes cash flow, improves efficiency and helps you save on costs.

|

|

|

|

|

|

|

UPGRADE TO TLS 1.2 PROTOCOL NOW! Effective from 1st July 2018, support for TLS 1.0 and TLS 1.1 will be discontinued

|

The rise in frequency and intensity of potential threats in the eCommerce space has made it imperative for websites to adopt TLS 1.2, a robust data security protocol that enables digital devices to communicate securely over the internet. TLS 1.2 is the latest version of TLS (Transport Layer Security) protocol, which aims to ensure privacy and data integrity between two or more communicating computer applications. With this upgrade, secure server-to-server connections will be established for processing online transactions successfully without potential threats.

The rise in frequency and intensity of potential threats in the eCommerce space has made it imperative for websites to adopt TLS 1.2, a robust data security protocol that enables digital devices to communicate securely over the internet. TLS 1.2 is the latest version of TLS (Transport Layer Security) protocol, which aims to ensure privacy and data integrity between two or more communicating computer applications. With this upgrade, secure server-to-server connections will be established for processing online transactions successfully without potential threats.

The Payment Card Industry ("PCI") council, along with Visa and MasterCard, have mandated all Merchants, Service Providers and Banks to ensure that their systems are completely TLS 1.2 compatible. Effective from 1st July 2018, CCAvenue will discontinue support for previous versions TLS 1.0 and TLS 1.1. Transactions attempted using these protocols will be declined after midnight 30th June 2018. If you have not yet upgraded to TLS 1.2 security protocol, please do so at the earliest.

|

|

|

|

|

|

|

CCAVENUE.COM IS GDPR COMPLIANT; ENSURES CUSTOMER'S DATA PRIVACY, PROTECTION AND SECURITY

|

|

Fundamentally, almost every aspect of our lives revolves around data. From social media companies, to banks, retailers, and governments, almost every service we use involves the collection and analysis of our personal data, which may be stored by organizations. Data breaches inevitably happen. Information is lost, stolen or otherwise released into the hands of people who were never meant to see it - often having malicious intent. In a bid to address these data security concerns, the European Commission introduced General Data Protection Regulation (GDPR), a new EU-wide privacy and data protection law designed to give EU citizens more control over their personal data. The GDPR is also applicable to globally operating organizations that are involved in data processing activities.

|

|

|

|

|

|

|

CCAVENUE ADDS MORE PAYMENT OPTIONS TO ITS NETWORK

|

|

|

|

|

|

INDUSTRY NEWS

|

|

|

Total BBPS Transactions in march stood at 31.5 million, up 75% YOY

Source: Medianama

The Bharat Bill Payment System (BBPS) has facilitated 31.5 million transactions in the month of March, up 75% YoY from 18 million recorded in March last year, revealed the NPCI.

Read More

|

|

| |

|

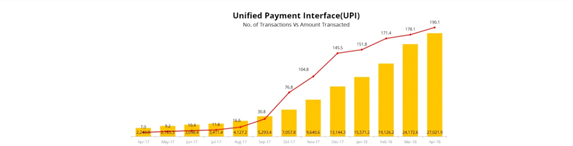

UPI TRANSACTIONS GROW TO 190.1M IN APRIL 2018; RS 27,021.9CR TRANSACTED

Source: Medianama

The Unified Payment Interface (UPI) saw an increase of 7% in the total transaction volumes taking place between March and April 2018, according to data published by NPCI.

Read More

|

|

| |

|

UIDAI BEEFS UP DATA SECURITY, LIMITS AADHAAR DATA ACCESS FOR WALLET COMPANIES

Source: inc42

After mobile wallet transactions fell 13% to 268.79 Mn in March 2018, looks like the wallet companies are ready to record more downfall in the first quarter of 2018.

Read More

|

|

| |

|

BANKS AND DIGITAL WALLETS TO NOW TARGET 30 BN DIGITAL PAYMENTS IN FY 2018-19

Source: inc42

If we go by the recent reports, the digital payments adoption in India is on a constant rise. The government has set up separate targets for institutions to boost volume of digital transactions.

Read More

|

|

| |

|

|

|

Disclaimer: We do not claim ownership over the images / articles appearing in the Industry News section. They are used for information purposes only and in no way are meant to claim ownership over any of the above mentioned. All photos, videos, articles, etc. are copyrighted to their original owners.

|

|

|

|